The crypto market bounced back this week, with Bitcoin surging to a record high and the total valuation of all coins reaching over $3.5 trillion.

Traders are betting on a new crypto bull run that will push Bitcoin (BTC) to $150,000 and most altcoins higher.

As excitement builds in the crypto community, altcoins are likely to take center stage in what’s being dubbed “altcoin season.” In this context, it’s crucial to identify which projects have solid fundamentals and technical indicators. This article delves into a comparative analysis of Polkadot (DOT) and Berachain (BERA), evaluating the one to buy and the one to potentially avoid.

Crypto to Buy: Polkadot

Polkadot stands out as one of the more contrarian assets in this current bull market. One of its significant advantages is a notable staking yield of 11.5%, surpassing many Layer-2 solutions like Ethereum (ETH), TRON (TRX), and Solana (SOL).

Beyond its attractive yield, Polkadot is in a unique position, having been in a three-year consolidation phase, fluctuating between $3.76 and $11.33. This stagnation is reminiscent of Monero’s (XMR) price action over the past two years, which eventually led to a significant uptick. According to the Wyckoff Theory, Polkadot appears to be in the accumulation stage, often followed by a markup phase defined by heightened demand.

Moreover, DOT has established a triple bottom support at $3.76, a notable floor it hasn’t breached since the beginning of 2023. Analysts forecast a possible rebound to at least $11.32—a promising 132% increase from current levels. Breaking through this resistance could usher in further gains, targeting the 50% retracement level at $30, representing a staggering 500% upside from its current value.

Crypto to Sell: Berachain

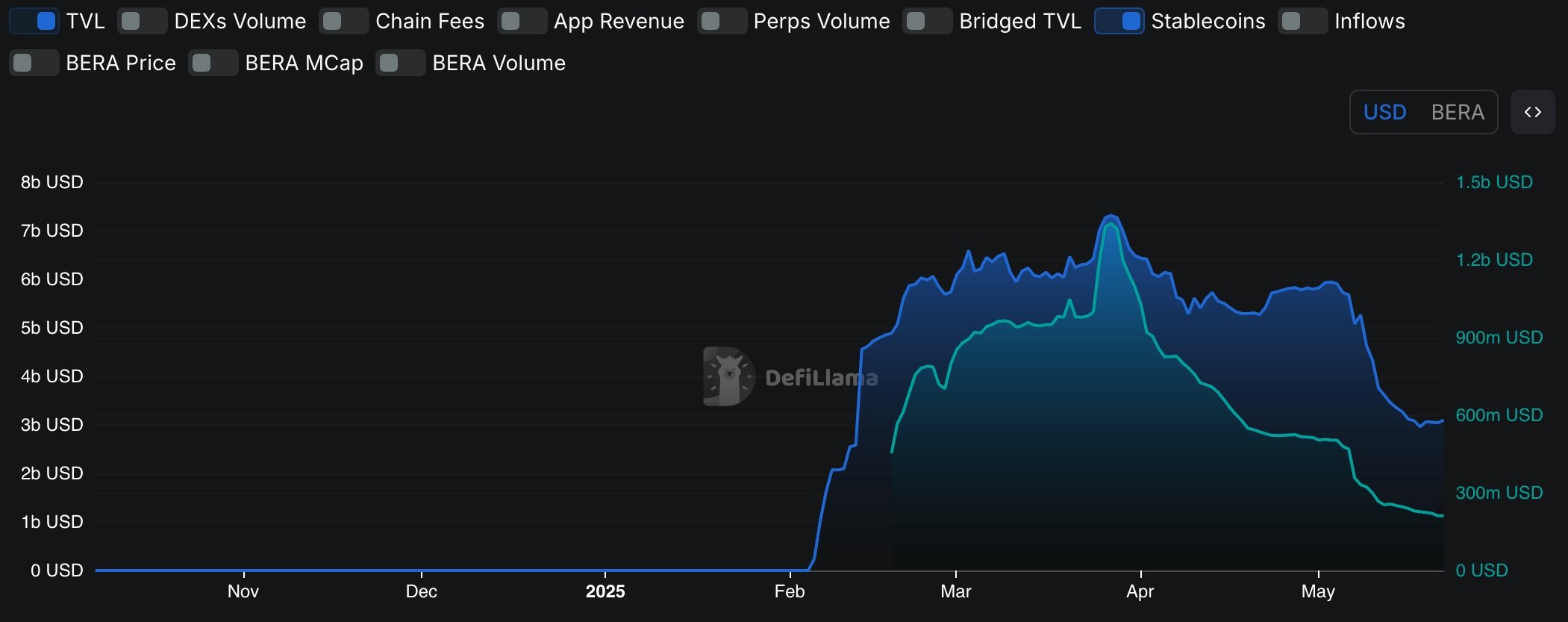

In contrast, Berachain currently presents itself as a prime candidate for divestment based on both fundamental and technical indicators. A worrying trend is evident: the total value locked (TVL) within the Berachain network has plummeted by 43% over the last 30 days, currently standing at $3 billion.

More alarmingly, the market capitalization of stablecoins within its ecosystem has nosedived from over $1.6 billion earlier this year to a mere $300 million. This dramatic decline suggests a significant slowdown in network growth and overall demand.

Adding to the gloomy outlook, Berachain is set to initiate monthly token unlocks starting in February next year, continuing through March 2028. These unlocks are likely to flood the market with additional supply, exerting downward pressure on the coin’s price at a time when demand is faltering.

Currently, BERA has fallen below the 50-period moving average on the eight-hour chart, forming a small rising wedge pattern that implies a potential drop to its all-time low of $2.70. This combination of technical and fundamental weakness suggests that now may not be the right time to invest in Berachain.