The first week of June proved to be bullish for some, while other altcoins faced corrections. Nevertheless, in the coming few days, we could see a change in momentum in altcoins for different reasons.

BeInCrypto has analyzed three such altcoins for investors to watch this week and what direction they are heading in.

Aptos (APT)

APT has been on a downtrend for nearly a month, trading at $4.67 at the time of writing. However, a major token unlock this week could change the trajectory of the altcoin. Investors are closely monitoring this event, as it could spark significant price movement and volatility.

Over 11.31 million APT, worth $52.7 million, will enter circulation during this token unlock. Historically, APT has experienced price surges before such unlocks. The Ichimoku Cloud indicator also shows a bullish signal, even though it remains above the candlesticks, suggesting that the market may have some upward potential.

Given the bullish signals, the altcoin could benefit from this momentum and potentially breach the $4.79 resistance, aiming for a rise to $5.06. This would mark the end of the downtrend and indicate positive price movement. However, if the bullish momentum fades, APT could struggle to break $4.79 and slide back to $4.49 or $4.33.

Celo (CELO)

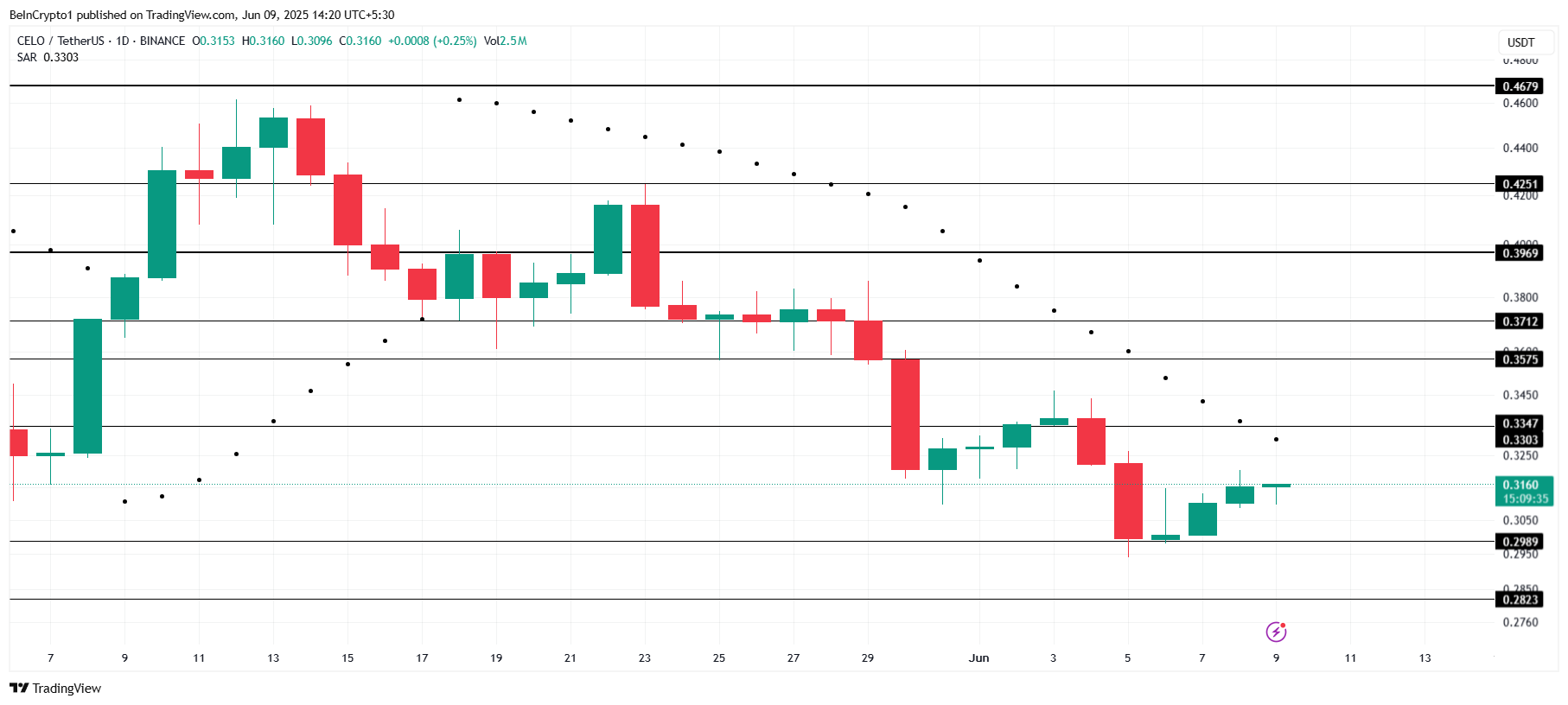

CELO is preparing for a major update after transitioning from a Layer 1 to an Ethereum Layer 2 chain. The protocol is set to launch its first significant update, generating excitement within the community. The upcoming changes are expected to improve scalability and enhance CELO’s overall functionality in the ecosystem.

The Isthmus upgrade will activate on the Baklava testnet on June 11, introducing important improvements in scalability, interoperability, and fault-proof security. These upgrades could fuel positive market sentiment, potentially allowing CELO to breach the $0.334 resistance. If successful, the price could rise towards $0.357, marking a positive breakout.

Despite the excitement surrounding the upgrade, the Parabolic SAR indicates that bearish momentum is still present. This could counter the positive hype and prevent the altcoin from sustaining upward momentum. If the selling pressure increases, CELO could drop to the $0.298 support level or even lower to $0.282, invalidating the bullish outlook.

Immutable (IMX)

IMX is currently trading at $0.51, just under the key resistance level of $0.53. The token is preparing for a significant unlock on June 13, with about 24.52 million IMX, worth over $12.67 million, entering circulation. This event could influence price action, depending on market sentiment leading up to it.

If the broader market turns bullish before the unlock, IMX could break through the $0.53 resistance. A successful breach of this level would likely drive the altcoin towards $0.59. Positive market cues and the unlock event could spark a rally, allowing IMX to test higher price levels.

However, the MACD indicates that bearish momentum is still active, which could hinder IMX’s recovery. If the selling pressure persists and outweighs any bullish momentum, IMX may fall through the support of $0.49. A decline to $0.46 would invalidate the bullish thesis, signaling a continuation of the downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.