Internet capital markets (ICM) is a fast-growing trend in the crypto space, fundamentally altering the way we think about investment and asset creation. By allowing creators and backers to turn innovative ideas — from memes to applications — into tradable assets, ICM is democratizing capital formation. Here is everything you need to know about Internet Capital Markets in 2025.

KEY TAKEAWAYS

➤ Internet Capital Markets (ICM) enable anyone to tokenize internet-native ideas into tradable assets.

➤ ICM bypass traditional financial gatekeepers, offering faster, cheaper, and more accessible capital formation without banks, brokers, or accreditation.

➤ Platforms like Believe simplify token creation, allowing businesses to launch tokens directly from social media with no coding required.

➤ Despite their promise, ICM tokens face criticism for volatility, lack of oversight, and similarities to meme coins regarding their speculative nature.

What are Internet Capital Markets?

Internet Capital Markets (ICM) refer to a new class of cryptocurrencies focused on tokenizing internet-driven ideas. These tokens can include:

- Applications

- Websites

- Projects

- Memes

Essentially, developers and businesses create tokens for their concepts, which then become tradeable assets. This structure allows anyone to invest in a project by purchasing the tokens associated with its idea, establishing a globalized capital market that mirrors the stock market but is unbounded by geographical constraints.

The rise of ICM can be traced back to early 2025, particularly popularized on platforms like X. The terminology originated from an influential essay by Multicoin Capital, titled The Solana Thesis: Internet Capital Markets, where Kyle Samani discusses Solana’s capability to support decentralized, internet-native capital formation.

The philosophical roots of ICM can be attributed to Anatoly Yakovenko, co-founder of Solana Labs, who envisioned the platform as a decentralized NASDAQ.

Internet Capital Markets vs. Capital Markets

Traditional capital markets are designed to raise capital through trading shares, bonds, and other long-term investments. The key distinction between traditional capital markets and ICM lies in access.

For instance, accessing traditional capital markets often necessitates substantial hurdles for both companies and investors. Corporations looking to raise funds typically need to partner with investment banks, undergo exhaustive audits, and comply with comprehensive regulatory frameworks — measures intended to protect investors.

However, these safeguards come with costs; they render the process lengthy, expensive, and often inaccessible to many startups and international projects, resulting in limitations on who can participate in capital formation.

By contrast, ICM offers increased availability, access, speed, and reduced costs, eliminating intermediaries like banks and brokers. With no geographical restrictions or time limitations, ICM provides direct access to users and is more cost-effective for both projects and investors.

Moreover, traditional markets may require investors to become accredited before accessing more lucrative investments. In the U.S., for instance, one must possess a net worth exceeding $1 million or an annual income exceeding $200,000 to qualify as an accredited investor, effectively excluding the majority from valuable opportunities.

ICM effectively democratizes investment, allowing anyone, regardless of their financial status, to participate in capital markets.

| Capital Markets | Internet Capital Markets |

|---|---|

| Geographical restrictions | Globally available 24/7 |

| Regulatory hurdles | Reduced costs for projects and investors |

| Often requires accreditation | Available to anyone/institution |

| Offers legal protections for investors | Does not have regulatory oversight |

Internet Capital Markets vs. Meme Coins

While ICM represents an innovative wave in the crypto sphere, it faces criticism for resembling meme coins.

While ICM tokens are primarily launched by developers rather than random individuals, they still lack a robust vetting process, which raises concerns about the ability to ensure project promises are met.

Additionally, ICM tokens are often criticized for their inherent lack of value and high volatility, drawing parallels with meme coins that many perceive to be extractive due to their limited practical use.

Despite the criticisms, ICM and meme coins differ fundamentally in their goals. ICM seeks to facilitate on-chain investing and crowd-funding for internet-driven projects, while meme coins are designed to exploit fleeting internet trends.

Regardless of your views, it’s crucial to approach both concepts with cautious optimism, understanding the inherent risks and potential returns associated with each.

Where to Buy ICM Tokens

The Believe app serves as a cornerstone for the emerging ICM ecosystem, centered around its native token, Launch Coin (LAUNCHCOIN). Created by Ben Pasternak, Believe allows users to transform nearly any idea into a tradable token simply by posting a tweet, eliminating the need for coding.

Tokens are instantly created on Solana, and Believe has been compared to pump.fun, which employs similar mechanics, including:

- A bonding curve

- Automatic token listings on a decentralized exchange (DEX) or graduation

- A threshold market cap of $100,000 before DEX listing (~$90k on pump.fun)

What sets Believe apart from similar platforms is its dynamic fee structure; early buyers pay higher fees, which later reduce to 2%. Furthermore, creators share fees with the Believe platform equally.

Top ICM Tokens in 2025

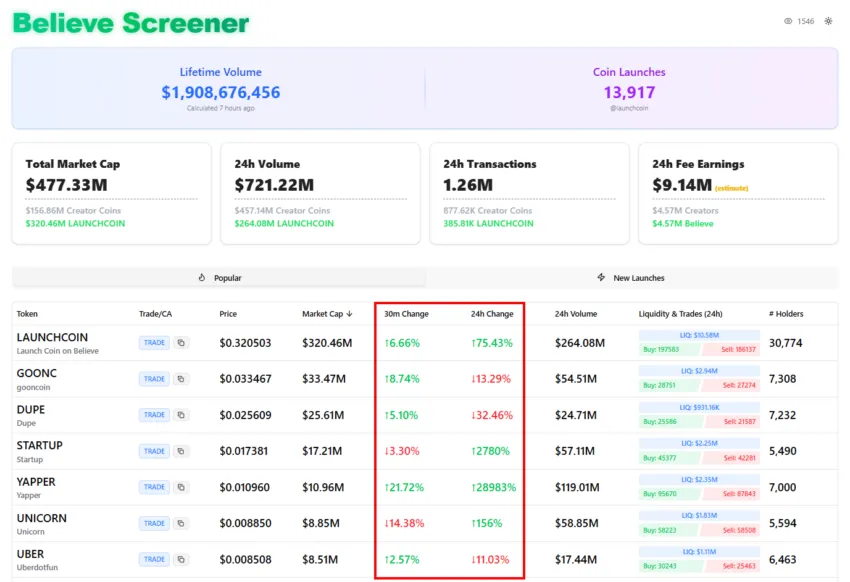

Launch Coin (LAUNCHCOIN), the native token of the Believe app, is leading the ICM sector. Originally named the Ben Pasternak token (PASTERNAK), it underwent a rebranding after its initial launch. With a maximum supply of 1,000,000,000 LAUNCHCOIN, it debuted shortly after the Multicoin essay on ICM.

Other notable ICM tokens by market cap include:

- Vine Coin (VINE): A token aimed at reviving the once-popular Vine social media platform.

- Dupe (DUPE): A platform designed to help locate similar products at lower prices.

- Jelly-My-Jelly (JELLYJELLY): A video chat platform facilitating clip-sharing with friends.

A Bold Reimagining of Investing

Internet capital markets represent a radical rethinking of how capital is raised, accessed, and employed in our evolving digital landscape. Whether this model establishes itself as a sustainable alternative to traditional capital formations remains to be seen, but what is clear is that the boundary between investing, building, and creating online is becoming increasingly indistinct. ICM lies at the forefront of this transformation.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always do your own research (DYOR).