In the dynamic world of cryptocurrency trading, Telegram trading bots have emerged as invaluable tools, offering automated solutions that connect directly to crypto exchanges. These bots allow users—whether they are new entrants or seasoned professionals—to execute trading signals seamlessly, eliminating the need for manual intervention.

The appeal of Telegram trading bots lies in their numerous benefits: they facilitate 24/7 trading, enable rational, emotion-free decisions, provide rapid execution of trades, and support various exchanges. They also allow for straightforward setups with built-in risk management features. However, potential risks accompany these conveniences, including API key security concerns, market volatility, the necessity for technical knowledge, the prevalence of scam bots, and the possibility of bot failures.

This guide will delve into what Telegram trading bots are, how they function, their associated risks and benefits, and provide a step-by-step setup process to get you started.

What Are Telegram Trading Bots?

Telegram trading bots are automated tools designed to execute crypto signals and trades directly within the Telegram app. This means that when a trading signal is generated, the bot can execute buy or sell orders automatically, ensuring that you don’t have to manually intervene.

These tools enhance the trading experience by quickly automating buy and sell orders based on signals received from various channels or groups. For instance, if a professional trader tweets about a new token launch, a bot can quickly replicate that trade for you, facilitating immediate purchases of new tokens as they become available—a practice commonly referred to as “sniping.” The continuous nature of the crypto market benefits from these bots, enabling trading even outside of regular waking hours.

How Do Telegram Trading Bots Work?

Telegram trading bots operate by following crypto trading signals and executing trades on your behalf without manual effort. To perform these functions, bots require the use of API keys linked to your crypto exchange account. This connection allows the bot to place trades based on the parameters you’ve set.

For example, if you set a command that reads: “Buy BTC at $104,000 and sell at $102,000,” the bot will recognize this message and execute the order on your exchange automatically, typically within mere seconds.

Utilizing sophisticated algorithms, these bots execute trading instructions in a fast and efficient manner. Features such as stop-loss and take-profit commands allow you to customize your strategy, meaning you can halt the bot’s activity whenever needed.

Why Use Telegram Crypto Bots?

The benefits of using Telegram crypto bots include simplicity, speed, accessibility, and advanced features like copy trading—all from within a single chat application.

- Ease of Use and Accessibility: Users find Telegram bots intuitive and easy to navigate. Inside Telegram, you can interact with the bot using simple commands such as “/buy” or “/sell.” This simplicity is part of what makes trading approachable for everyone.

- Real-Time Execution and Speed: With their swift execution capabilities, these bots can process trades within seconds. This ensures that you don’t miss out on critical trading opportunities.

- Automation of Trades: Thanks to their 24/7 trading ability, a Telegram crypto bot can trade while you’re occupied, using rules you have previously set, thus removing the emotional element from trading.

- Can Follow Expert Signals: Many bots connect to professional signal providers, allowing you to replicate successful trading strategies without developing one yourself.

- Sniping New Token Launches: The capability of bots to buy new coins immediately upon release is a significant advantage, offering a better chance to purchase tokens at lower initial prices.

What Are the Key Features of Telegram Trading Bots?

Key features of Telegram trading bots mainly include automation, signal execution, portfolio tracking, and integration with various trading platforms.

Automation and Signal Execution

The automation feature is essential; as soon as a signal is posted in a Telegram channel, the bot can read and execute the trade without your input. This creates efficiency and effectively eliminates potential emotional trading mistakes.

As an example, imagine a signal saying: “Buy Ethereum at $2,500,” which the bot will promptly act upon, executing the trade automatically. This rapid response allows traders to maximize opportunities quickly and reduces the hassle of constant monitoring.

Portfolio Tracking and Alerts

By using a Telegram trading bot, you can efficiently manage investments across numerous platforms. The bot can track your portfolio, offering an organized view of your entire asset performance. Additionally, it sends alerts for trade entries or exits, ensuring you’re always updated on critical developments in your portfolio.

These alerts help facilitate better decision-making as you don’t need to constantly log into your various exchange accounts. Instead, you receive instant notifications about your trading activity directly through Telegram, making it particularly useful for busy traders.

Integration With Trading Platforms

Integration capabilities are another benefit of Telegram trading bots. By connecting directly to your crypto exchange through APIs, your funds remain securely housed within your exchange accounts, and the bot is limited to executing trades on your behalf without accessing your funds beyond that permission.

This streamlined approach allows monitoring and management of your trading activities directly from Telegram, providing flexibility and convenience.

What Are the Benefits and Risks of Telegram Crypto Bots?

Advantages for Beginners

For beginners, Telegram crypto trading bots present several advantages: they can trade around the clock, provide a simple trading experience, and offer essential risk management tools.

- 24/7 Trading: As these bots are active at all hours, they monitor the volatile cryptocurrency market continuously, allowing you to seize opportunities without needing to be awake yourself.

- Emotion-Free Decisions: Bots adhere strictly to trading rules, removing emotional influences that can often lead to impulsive decisions in trading.

- Speed and Efficiency: Bots can immediately analyze market conditions and execute orders far more quickly than a human trader can.

- Connects to Multiple Exchanges: Telegram bots typically support a wide range of exchanges, making it easy to manage your trades across platforms.

- Simplified Trading: Many bots feature user-friendly interfaces that simplify the trading process, especially for newcomers who might be intimidated by traditional trading platforms.

- Risk Management Tools: Most bots incorporate useful features such as stop-loss orders, helping to minimize potential losses.

Potential Risks and Limitations

Despite their advantages, Telegram crypto trading bots also come with risks that need to be understood, such as concerns regarding security, market unpredictability, and the presence of potentially unreliable bots.

- Security Concerns (API Keys): Managing API keys with caution is crucial to protect your account from unauthorized access. Best practices, like enabling two-factor authentication, significantly enhance security.

- Market Volatility and Unpredictability: While bots can act fast, they are not immune to market fluctuations. Sudden changes can lead to unexpected losses if a bot’s algorithm doesn’t account for those variations.

- Technical Knowledge Required: Setting up these bots is more straightforward than learning trading strategies, yet basic understanding remains essential for effective configuration.

- Scams and Untrustworthy Bots: Due diligence is imperative when selecting a bot, as the space can be rife with scams aiming to exploit unwary users.

- Bot Reliability and Maintenance: Like all software, bots can experience technical glitches, requiring regular monitoring and updates to ensure consistent performance.

How to Set Up a Telegram Trading Bot?

Setting up a Telegram trading bot involves choosing a bot, connecting it to your crypto exchange via API keys, configuring your trading strategies, and monitoring its performance.

Step 1: Choosing Your Bot and Setting Up Telegram

Begin by selecting one of the various Telegram trading bots available, recognizing that some are free while others require payment. Researching each option, reading reviews, and understanding their features will be key steps in finding the right fit for your trading strategy.

With a bot selected, if you don’t already have a Telegram account, create one. Then, navigate to the bot’s Telegram page to start a chat, typically initiated with a simple “start” command for setup guidance.

Step 2: Linking Your Crypto Exchange through API Keys

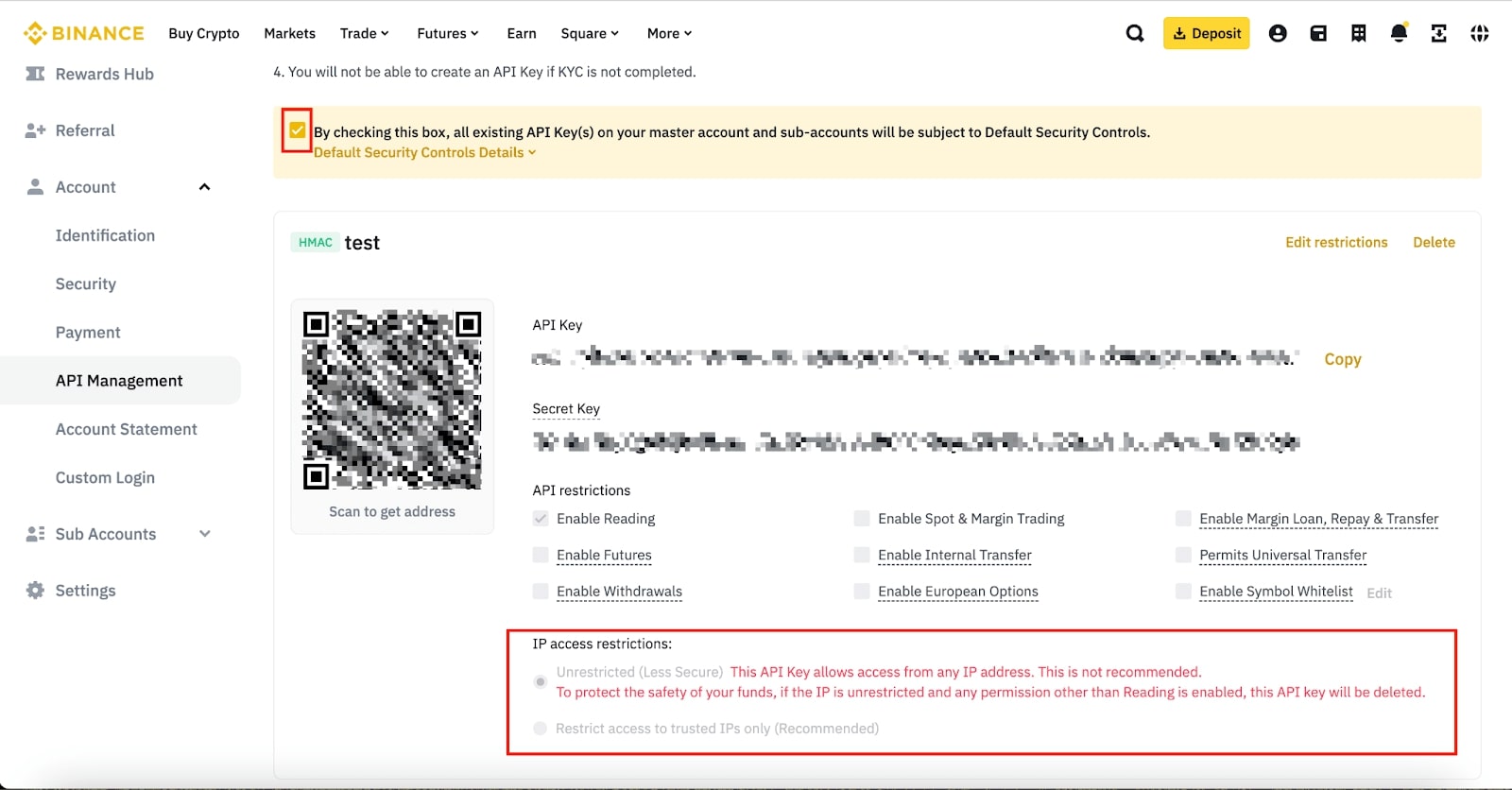

To allow the bot to buy and sell on your behalf, it must interface with your chosen exchange. This process involves navigating to your exchange account settings, typically found under “API Management.” Here, you can generate new API keys.

Always exercise caution by granting only necessary permissions—primarily “read” access—to mitigate risks. Once created, copy these keys into the bot’s setup area within Telegram.

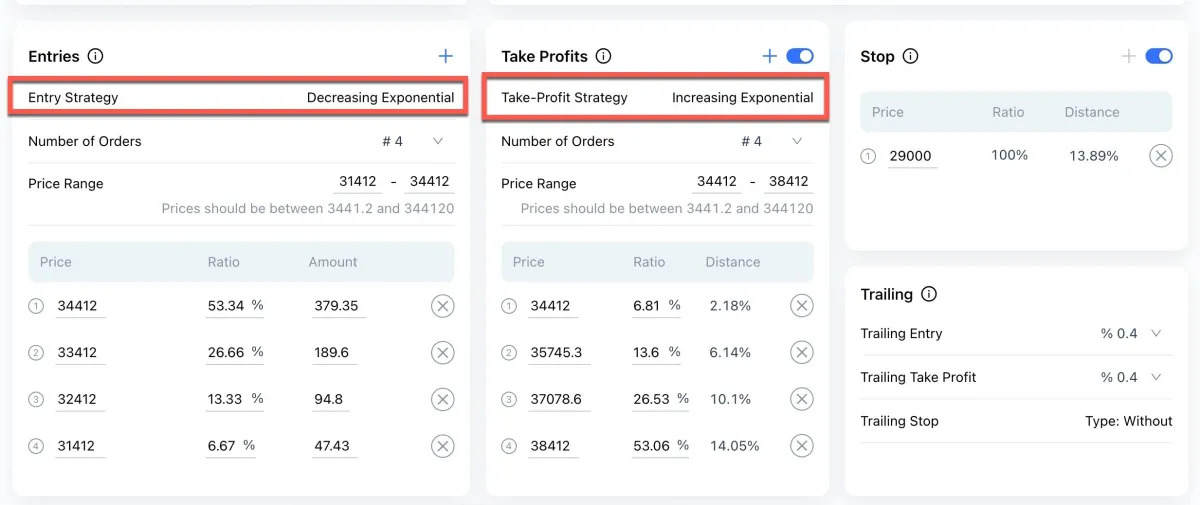

Step 3: Setting Up Your Trading Strategy

This step usually involves establishing parameters guiding the bot’s trading actions, such as which cryptocurrencies to trade, how much capital to utilize per trade, and establishing your risk management tools like stop-loss orders.

Step 4: Monitoring and Adjusting

Regular oversight of your bot is crucial after it is live. Most bots provide notifications about trades and portfolio updates directly within the Telegram chat, enabling you to adjust trading parameters as needed based on performance.

Are Telegram Trading Bots Real?

Indeed, Telegram trading bots are real and have seen widespread adoption in the cryptocurrency space. These bots are software tools leveraging the Telegram app to interact with your exchange via API keys for transaction execution. Well-known examples of Telegram trading bots include Cornix, Cryptohopper, Banana Gun, and Unibot, each adopted by numerous crypto users globally.