Bitcoin’s price action has turned somewhat sluggish following its unprecedented climb to a new all-time high of $122,838 on July 14. This rapid ascent marked a week filled with frenzied trading and heavy inflows, resulting in BTC breaking through several resistance zones in rapid succession. However, the exhilaration of hitting this peak quickly faded into a series of volatile intraday movements, leading to a pullback to around $116,000, with Bitcoin now oscillating between the $117,000 and $118,500 price range.

Related Reading

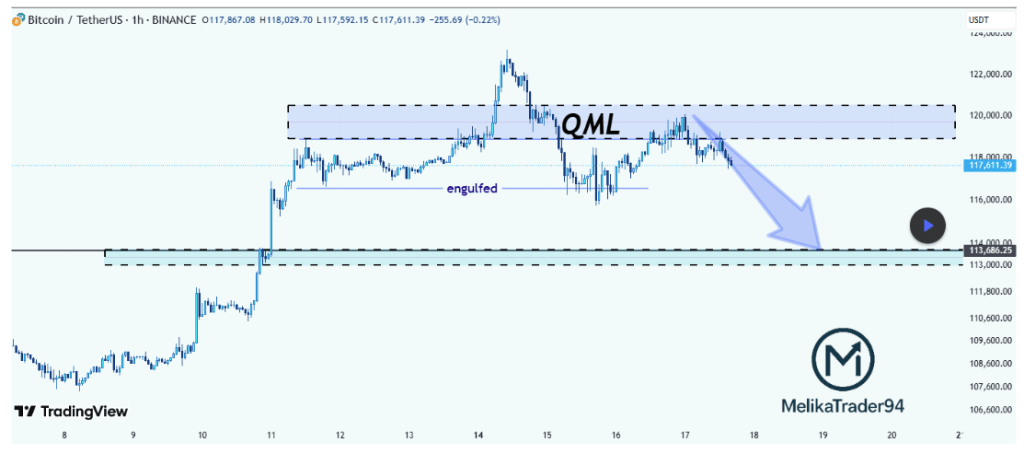

Crypto analyst Melikatrader94 has issued a notable bearish forecast, suggesting a potential drop for Bitcoin down to $113,000. This outlook is rooted in a technical analysis that reveals crucial support and resistance levels influencing Bitcoin’s immediate future.

QML Zone Rejection Points To Downtrend Toward $113,600

The technical insights from the hourly candlestick chart shared by Melikatrader94 illustrate a Quasimodo Level (QML) structure currently observed in Bitcoin’s price action. This QML structure, often seen as a bearish signal, is characterized by three peaks, with the central peak being the dominant one. According to the analysis, Bitcoin’s attempt to enter the $119,000–$121,000 zone triggered selling pressure from market participants.

The abrupt rejection after Bitcoin’s all-time high reinforces the bearish sentiment. This shift in momentum is critical because it signifies that sellers have gained the upper hand, hinting at further sell-offs ahead.

“BTC rejected from QML zone and the selloff confirms bears are active,” the analyst noted. The bearish outlook holds as long as Bitcoin remains beneath the QML zone, with considerable support expected around the $113,600 level, potentially serving as a bounce or consolidation point if prices trend downward.

A potential price pullback is anticipated around the $116,000 area before a more significant decline toward $113,600 occurs, according to the latest technical analysis.

Altcoins Under Threat As BTC Price Weakens

The anticipated Bitcoin drop to the $113,000 region could significantly impact altcoins, which have also experienced substantial gains recently. Many altcoins tend to follow Bitcoin’s movements, and as BTC struggles to gain upward momentum, signs of unease are beginning to emerge.

XRP stands out as a notable mover, having broken its eight-year resistance to achieve a new all-time high of $3.65. However, this rally appears to be stagnating, as it shows early signs of correction around the $3.45 zone. Ethereum, which rose alongside Bitcoin’s push to $122,000, climbed above $3,600 but has since entered a phase of consolidation just below $3,500.

Related Reading

Should Bitcoin dip below $116,000 in the upcoming days, the likelihood of altcoin outflows increases, leading to heightened selling pressure across the board. Interestingly, this scenario might also catalyze a detachment from Bitcoin’s influence among major altcoins, opening up the possibility for an altcoin season where these cryptocurrencies outperform Bitcoin, presenting traders with unique opportunities.

Featured image from Pixabay, chart from TradingView