Key Notes

- MetaMask launched its native stablecoin, mUSD, with a global rollout via MetaMask Card at over 150 million merchant locations worldwide.

- Bitmine has expanded its holdings to 2.15 million ETH, valued at $9.74 billion, following the recent acquisition of an additional 82,233 tokens.

- Technical analysis indicates support at $4,399 and resistance at $4,584, in anticipation of the Federal Reserve’s rate decision on September 17.

MetaMask, the largest wallet provider on the Ethereum network, successfully launched its native stablecoin, MetaMask USD (mUSD), on September 15. The launch has produced bullish momentum that helped stabilize Ethereum’s price around $4,495, despite an earlier 3% dip during the day.

MetaMask USD ($mUSD) is now live.

The best way in and out of crypto is here. pic.twitter.com/h6zSUao7Ka

— MetaMask.eth

(@MetaMask) September 15, 2025

The new token introduces significant liquidity incentives on Linea, alongside low-cost fiat onramps within MetaMask, enabling seamless integration with its Swap and Bridge functions. Notably, $mUSD will also be accessible globally through the MetaMask Card, which is usable at over 150 million merchant locations.

This strategic launch aligns Ethereum with the increasing adoption of stablecoins, particularly as U.S. corporations rush to integrate them since the enactment of the Genius Act by President Trump. By introducing mUSD, MetaMask empowers investors to maintain larger balances within the Ethereum ecosystem without needing to shift to stablecoins on competing networks.

The anticipated on-chain value added by MetaMask card transactions is also expected to bolster Ethereum’s price stability during periods of market turbulence when traders often seek refuge in stablecoins.

SΞR NEWS: Bitmine Immersion $BMNR has acquired 82,233 ETH ($370M), raising total holdings to 2,151,676 ETH ($9.71B).

The company still holds $569M in cash and turned a $20M investment in $ORBS into $214M. pic.twitter.com/lGf2lboOFD

— Strategic ETH Reserve (SΞR) (@SERdotxyz) September 15, 2025

Institutional activity further underpins a resilient narrative for the Ethereum ecosystem. On September 15, Bitmine shared updates revealing an increase in its holdings to 2.15 million ETH, valued at approximately $9.74 billion, following the acquisition of an additional 82,233 ETH.

With a treasury of $569 million, Bitmine’s crypto Net Asset Value (NAV) has now reached an impressive $10.31 billion, illustrating the firm’s strong long-term conviction in Ethereum amidst potential macroeconomic challenges.

Ethereum Price Forecast: Are Bulls Aiming for a $5,000 Breakout?

Despite a slight intraday decline, Ethereum is currently trading around $4,523. Recent technical analysis suggests that there’s potential for consolidation rather than capitulation. Data from Coinglass indicates that the recent 3% price dip was accompanied by $98 million in ETH long liquidations, while only $20 million in short positions were closed.

This imbalance leans bearish and highlights how the intraday losses were exacerbated by overleveraged traders taken by surprise by recent U.S. inflation data. Conversely, trading data suggests there is room for a rebound; ETH futures trading volume has surged 63.39% to $90.65 billion, with open interest ticking up by 0.17% to $63.98 billion.

The uptick in derivatives activity amid a spot price decline often indicates that previously overleveraged bull traders are repositioning for potential near-term moves after incurring losses of nearly $100 million within 24 hours.

Further analysis reveals essential support levels at $4,399 and immediate resistance at $4,584, with a sustained price close above $4,585 needed to re-establish a bullish outlook.

Moreover, the Commodity Channel Index (CCI) is sitting at 78.53, slightly elevated but still not in overbought territories. This neutral momentum could attract strategic traders looking to make speculative purchases before the critical Fed rate decision scheduled for September 17.

A break below $4,399 could potentially lead to a price drop towards $4,200.

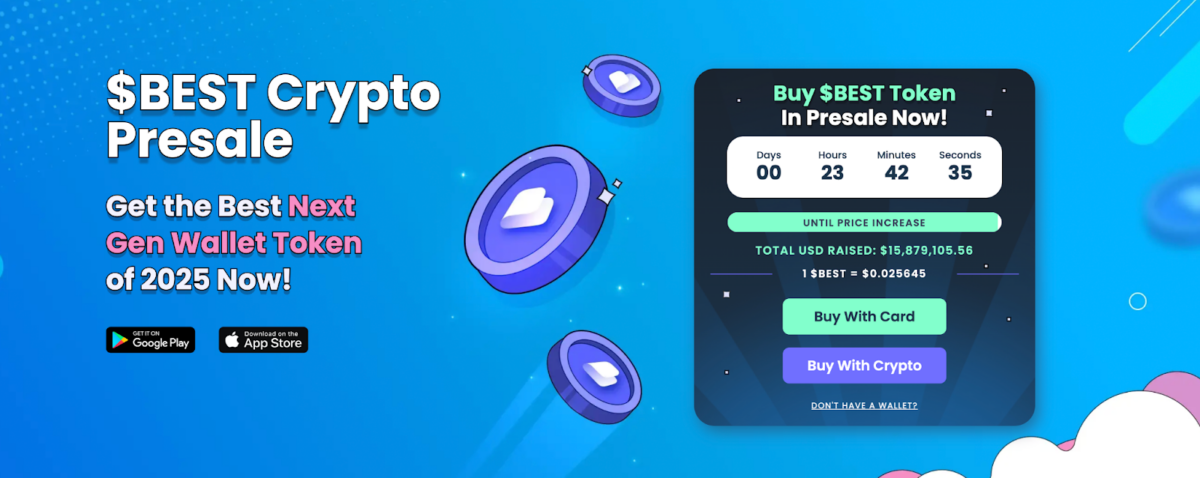

Best Wallet Presale Gains Momentum Alongside Ethereum Narrative

The positive sentiment surrounding the Ethereum ecosystem, especially in light of the upcoming U.S. Fed rate decision, has also increased demand for multi-chain storage projects like Best Wallet. With its promise of secure multi-chain solutions and institutional-grade security, Best Wallet has seen a significant uptick in demand in recent weeks.

Best Wallet Presale

As of now, Best Wallet’s presale has raised over $15.8 million, attracting investors who are moving away from stagnating top altcoins towards projects with greater upside potential. Interested participants can visit the Best Wallet website to join the BEST presale before the token price increases from its current rate of $0.0256 each.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.