Week in Review: Higher US Inflation Lifts Bitcoin; Trump Pardons CZ

Digital gold, Bitcoin, has once again shown its resilience, rising above $113,000, while political currents swirl around crypto, especially with Donald Trump’s decision to pardon Binance founder Changpeng Zhao (CZ). Alongside these major headlines, the crypto landscape has witnessed significant shifts, including a 500% surge in miners’ debt since the beginning of the year. Here’s a closer look at the prominent developments from the past week.

A Firm Market

The week kicked off with Bitcoin opening at $108,000, and by Tuesday, it had even tested $114,000. However, this excitement was tempered with a slight pullback during the week. Friday’s data revealing higher US inflation reignited investor confidence, pushing Bitcoin back up above $113,000 by Sunday evening.

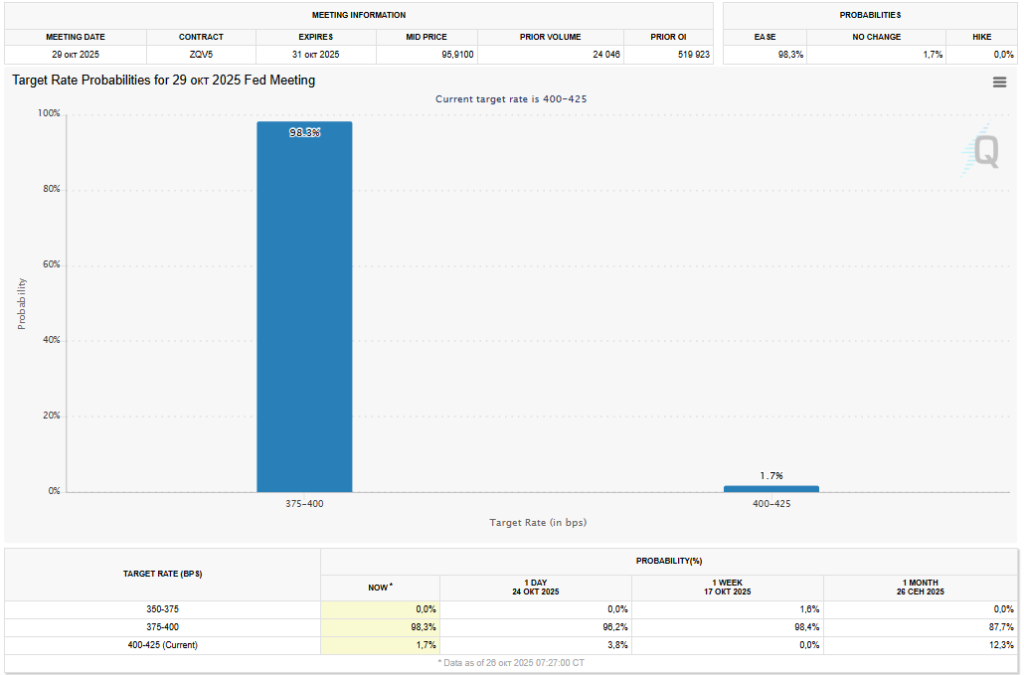

Recent data showed the consumer price index (CPI) rose by 0.3% in September, a slight decline from the 0.4% increase in August. Year-on-year, the unadjusted reading climbed to 3.0%. With traders ramping up odds on the Federal Reserve lowering the target rate to 3.75–4% at its meeting on October 29, confidence in crypto markets strengthened.

Source: CME FedWatch Tool

Despite brief dips during the week, Bitcoin saw an increase of 5.5%, raising its market capitalization to a staggering $2.26 trillion. Other major cryptocurrencies followed suit, with Ethereum hovering around $4,000 and BNB near $1,100. XRP stood out among the top ten by market value, increasing by 11% over the week.

The total crypto market value reached $3.92 trillion, firmly establishing Bitcoin’s dominance at 55.7% and Ethereum at 12.4%. Interestingly, the Crypto Fear and Greed Index now stands at 40, up from 29 the previous week, indicating a shift in market sentiment.

CZ’s Pardon

A seismic political event unfolded on October 22, when President Trump signed an order pardoning Changpeng Zhao, the founder of Binance. During a press briefing, Trump noted that many had supported CZ and urged that the charges against him be dropped.

Source: Alternative.me Crypto Fear and Greed Index

White House press secretary Karoline Leavitt stated, "President Trump exercised his constitutional authority, pardoning Mr. Zhao, who was prosecuted by the Biden administration as part of their war on cryptocurrencies." CZ himself expressed gratitude to Trump and emphasized his commitment to assisting the United States in further developing the crypto industry.

While the news was met with enthusiasm from much of the crypto community, dissenters from the Democratic Party criticized the decision. Congresswoman Maxine Waters accused Trump of corruption, and Senator Elizabeth Warren pointed out that CZ’s pardon was linked to lobbying efforts surrounding the president’s crypto projects.

Miners’ Debts Surge

The mining sector has not been without its challenges. In September, mining profitability for Bitcoin dipped by over 7%, with daily revenue per 1 EH/s of hashrate falling from $56,000 to $52,000. Jefferies analysts attributed this decline to a slight dip in Bitcoin’s price alongside a notable increase in network computing power.

Source: Hashrate Index.

Adding to this precarious scenario, Bitcoin miners’ debt has surged by a staggering 500% year-on-year, climbing from $2.1 billion to $12.7 billion. This dramatic increase highlights the investment needs for new mining equipment and fulfilling demands related to artificial intelligence.

Despite these challenges, miners’ shares are witnessing significant growth, with the market capitalization of the 15 largest US mining players hitting $90 billion by mid-October.

What’s Hot in Crypto?

In a lighter vein, here’s what to discuss with friends:

- A solo miner recently mined a Bitcoin block, earning $347,455.

- Gamers, World and Eightco have set their sights on you.

- DeFi Llama has reinstated Aster but dubbed its data a “black box”.

- Coinbase has invested $25 million into relaunching the UpOnly podcast.

Tech Innovations: An AI Browser

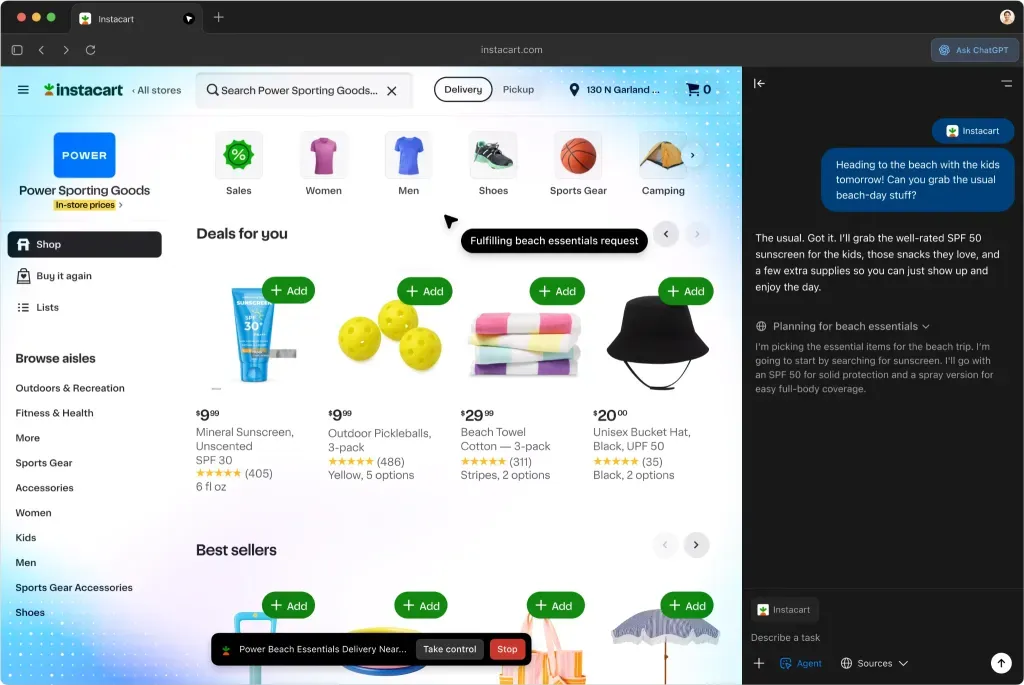

Another notable headline this week was the launch of OpenAI’s Atlas AI browser, featuring an integrated ChatGPT chatbot and virtual assistants. Currently available for download on macOS, Atlas allows for seamless importation of bookmarks, history, and saved passwords from Chrome or Safari.

Source: chatgpt.com.

The standout feature of this browser is the "Ask ChatGPT" button, which enables users to inquire about the contents of their active tabs. It is also equipped with a memory function that recalls user activity and can even switch to assistant mode for tasks such as booking hotels or making online orders.

Tether Reaches New Milestone

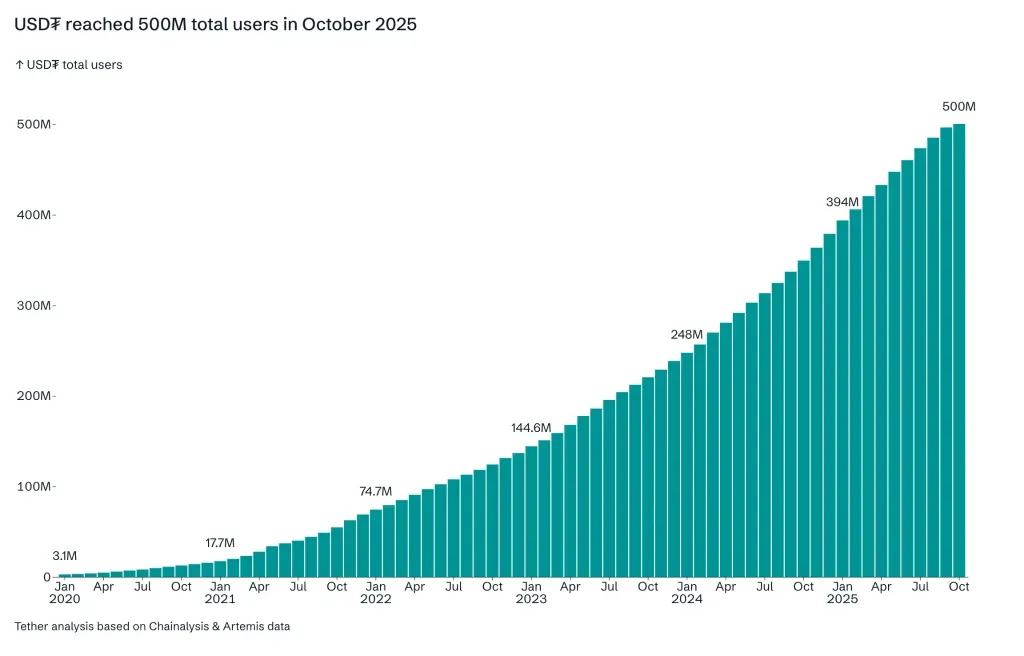

Tether recently announced a significant milestone—its user base has surpassed 500 million users. This achievement reinforces its position in the market where USDT now boasts a market capitalization exceeding $182 billion, capturing roughly 59% of market share.

Source: X/paoloardoino.

As the market evolves, Tether continues to expand globally. Plans to introduce a new stablecoin compliant with US regulations are underway, as reported by Paolo Ardoino, Tether’s CEO.

The second half of this year has witnessed a 125% increase in global retail transactions with digital assets, highlighting the growing role of stablecoins in cryptocurrency adoption.

These developments encapsulate a dynamic week in the crypto world, marked by significant financial fluctuations, political maneuvers, and groundbreaking technological advances.