Crypto News: Bitcoin Market Correction Ends — XRP, ADA, and LINK Identified as the Best Altcoins to Buy for November Recovery

A Market Reset and Recovery Phase

With Bitcoin’s correction phase appearing to conclude, analysts are setting their sights on a promising November for altcoins such as XRP, Cardano (ADA), and Chainlink (LINK). Following the market reset triggered by October’s staggering $19 billion crash, the landscape is primed for recovery plays. Bitcoin is leading the resurgence, but these altcoins are also drawing significant interest.

Bitcoin Bounces Back After a $19 Billion Crash

The recent financial shakeup on October 10 caught many investors off guard when Bitcoin plummeted to $104,000. However, renowned analyst Geoff Kendrick from Standard Chartered suggests that this downturn might have laid the groundwork for a robust rally. He predicts that Bitcoin could soar as high as $200,000 by year-end, provided that ETF inflows continue to rise and the U.S. Federal Reserve maintains its easing stance on interest rates.

Kendrick notes an important shift: ETF inflows are currently on a recovery trajectory, with $477 million of net inflows recorded this past week. This surge indicates a revived interest from institutional players and suggests that Bitcoin is reclaiming its status as a safe haven, especially with gold reaching new heights. Consequently, many traders are marking it as the best cryptocurrency to buy for November.

XRP Price Outlook Turns Positive Following a Sharp Drop

The recent volatility caused XRP to experience a significant drop, reaching as low as $0.77 on Binance during the October crash—a staggering 72% decline in just one day. However, some analysts, including well-known crypto expert Crypto Kaleo, are optimistic about XRP’s potential for a robust recovery. Kaleo pointed out that XRP’s current setup resembles patterns noted in late 2017 when a similar flash crash preceded a remarkable run that saw XRP hit $3.3.

Currently trading below $2.5, XRP is attracting attention from both retail buyers and large investors (whales) who anticipate a clean breakout. Given the renewed buying pressure and the historical patterns it reflects, XRP is emerging as a top contender for the best cryptocurrency to buy this November.

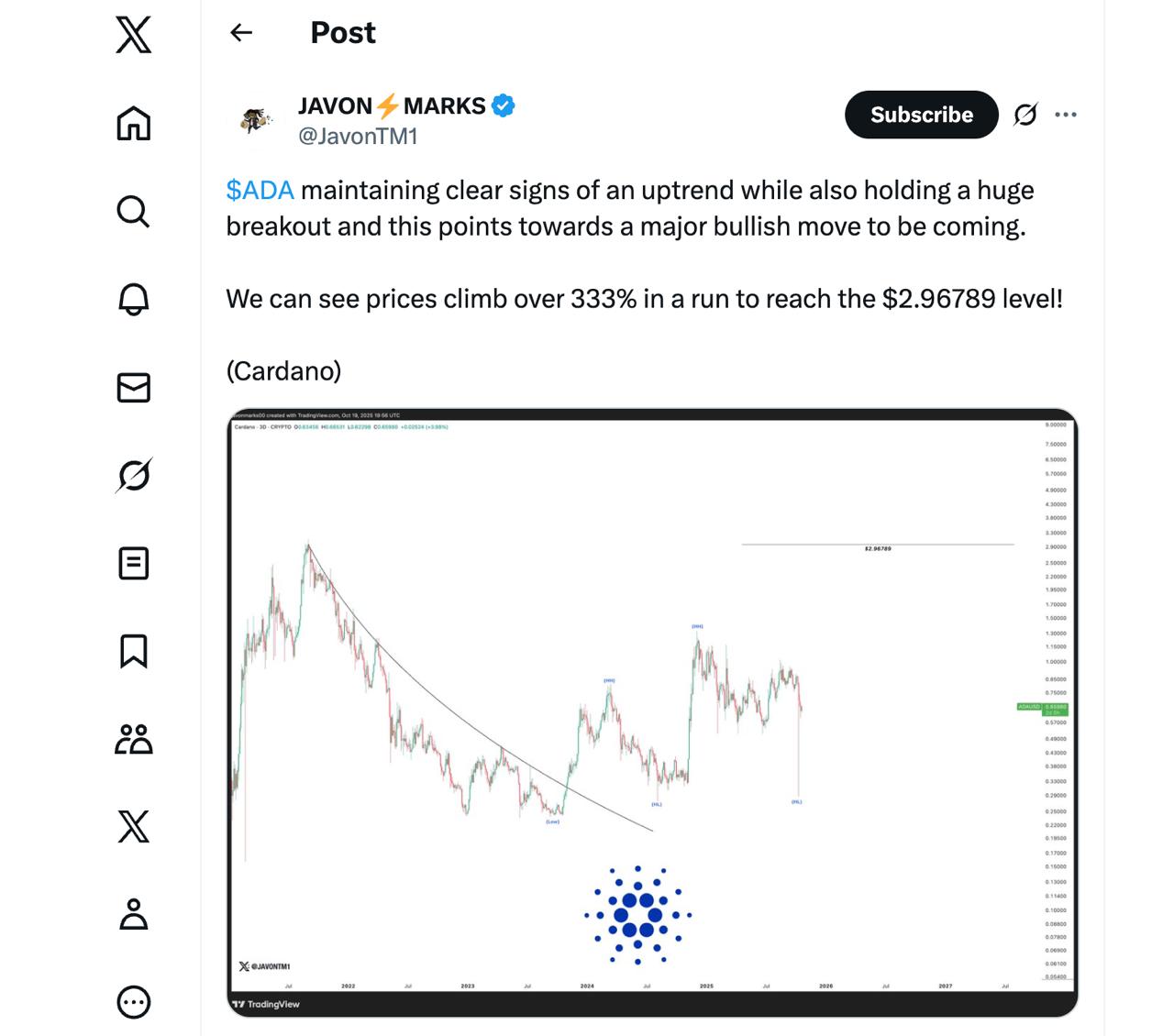

Cardano: Signs of a Potential 333% Rally

Long-term investors have been keeping a close eye on Cardano (ADA). While its price has seen some drops since early October, analysts point to encouraging trends. Market commentator Javon Marks believes ADA has maintained its breakout structure, positioning it for a robust rally. He projects a potential gain of 333% to $2.96, emphasizing that ADA has been consistently making higher highs and higher lows throughout 2023.

Even after dipping to $0.279, Cardano’s price held firm against critical support levels, allowing for optimistic forecasts. Another analyst, Chris O, anticipates potential highs in the range of $5 to $8 during this cycle should market sentiment continue to improve.

Chainlink Positioned for Institutional Growth

Chainlink (LINK) is another promising altcoin, currently trading around $17.52 following a brief pullback. Recent filings by major investment firms like Grayscale and Bitwise to launch Chainlink ETFs on NYSE Arca suggest substantial institutional interest, potentially opening new avenues for traditional investors.

Whales are also accumulating LINK tokens, having purchased over 54 million tokens throughout October. This surge in buying activity indicates a strong base is forming, especially since exchange reserves for LINK have decreased by 33 million since July. With its ongoing initiatives in real-world asset (RWA) integration and partnerships with major organizations like S&P Global and SWIFT, Chainlink remains a leading choice for those seeking steady, utility-driven growth.

MAGACOIN FINANCE: Increasing Whale Interest Before Q4 Breakout

Amid the shifting tides, MAGACOIN FINANCE is gaining traction as traders pivot towards new altcoins. The project has recently drawn in over 21,000 new investors following its announcements of listings on both major decentralized and centralized exchanges. Observers note that whales are strategically building positions below $0.0006, anticipating what could be one of the most significant breakouts in Q4 among lower-cost cryptocurrencies.

For those holding prior to a possible price surge to $0.1, the potential for gains could be as high as 1000% from current levels. Many perceive MAGACOIN FINANCE as an opportunity to diversify beyond more established assets while still seeking significant upside.

Why MAGACOIN FINANCE?

- Whale entries ahead of listings

- Early-stage altcoin trading under $0.0006

- Transparent, community-driven model

With growing interest, MAGACOIN FINANCE joins the ranks of Bitcoin, XRP, ADA, and LINK as one of the best cryptocurrencies to consider this November.

How Traders Can Position Themselves Now

Following the panic induced by the October crash, traders are gradually shifting to a more proactive mindset. The recent market downturn has opened up fresh entry zones for top cryptocurrencies. For those considering diversification into emerging assets like MAGACOIN FINANCE, positioning now could place them ahead of the next breakout wave.

For ongoing updates, visit magacoinfinance.com, follow their news on X, or engage with the community on Telegram to observe how major holders are aligning their portfolios ahead of Q4.

Author: Krasimir Rusev, a seasoned journalist specializing in cryptocurrency and financial markets. His expertise offers readers reliable insights into the latest trends and developments in the crypto space, making him a trusted source for investors and traders alike.