Bitcoin Mining in 2025: A Year of Record Trials and Transformations

Introduction

As Bitcoin reached unprecedented heights in price, miners faced a brutal reality. The juxtaposition of record-high Bitcoin values with some of the lowest mining margins in history painted a picture of an industry grappling with increasing operational challenges. The year 2025 guided miners through a landscape filled with competition, innovation, and the necessity for adaptation.

Key Highlights of the Year

- Hashrate Milestone: Bitcoin’s hashrate surged past the symbolic 1 ZH/s mark.

- Economic Pressures: Rising mining difficulty and stagnant prices led to severe profitability challenges.

- US Dominance: Despite looming tariffs, the United States solidified its position as the leading force in Bitcoin mining.

- AI Diversification Trends: Accelerated shifts towards artificial intelligence by miners seeking additional revenue streams.

The Strengthening Network

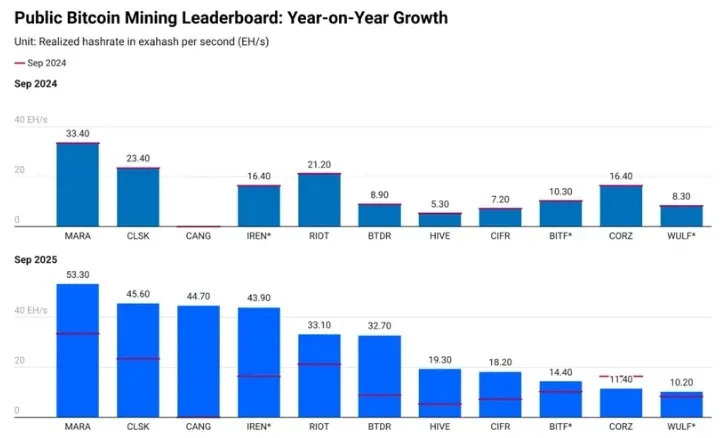

At the outset of 2025, Bitcoin’s hashrate was around 800 EH/s, climbing to a record 1.15 ZH/s by October, a growth of approximately 25%. Significant contributors to this expanding hashrate were the Antminer S21 rigs, which accounted for about 20% of the total compute power by October. This increase in hashrate often meant more competition and higher barriers to entry.

The heightened difficulty, which reached 155.98 T in late October, presented a solvable puzzle for miners. This increase, coupled with the April 2024 halving, resulted in miners primarily relying on block subsidies for revenue, as fees accounted for less than 1% of their income.

Profitability Under Siege

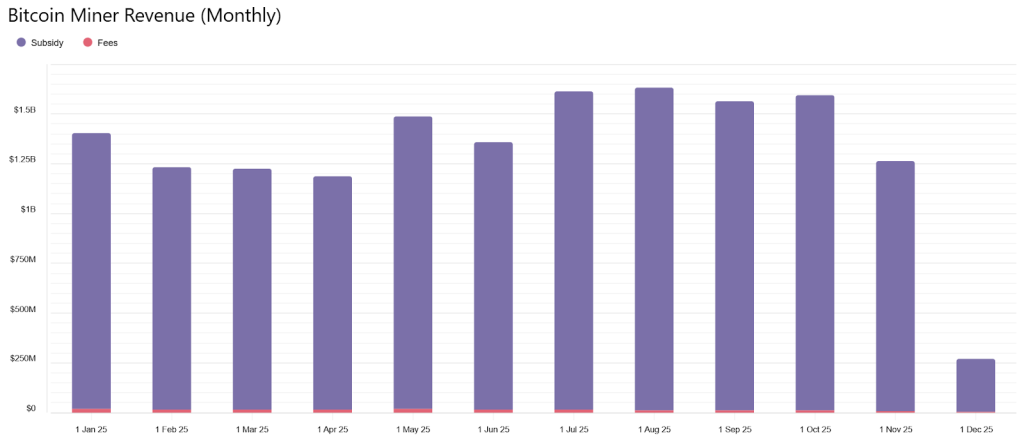

With Bitcoin’s soaring price, miners hoped to reap the rewards. However, by July, the cost to mine a single Bitcoin was about $74,600, with non-cash expenditures pushing the figure to around $137,800. Subsequently, revenues fluctuated between approximately $1.19 billion and $1.63 billion monthly—a stark reminder of the profitability crunch.

Despite Bitcoin achieving a record price of $126,080 in October, the relationship between hashprice and mining profitability became increasingly untenable. The difficulty of operations meant that many miners were hovering near breakeven, often seeing payback periods stretch to more than 1,000 days.

The Hashprice Decline

The hashprice, which reached a peak of $63.9 in July, subsequently plummeted below $40, indicating a downward trajectory that mirrored increasing network difficulty and competition. Amid this turmoil, public miners began pivoting to diversify their portfolios.

Diversification into AI Infrastructure

Under the surface, the trend of miners diversifying into high-margin artificial intelligence (AI) services was already gaining traction. The SALT conference in August saw industry leaders discussing megawatt monetization rather than sheer hashrate. Their remarks reflected an industry desperate to stay profitable amid rising operational expenses.

Various companies, like CleanSpark, doubled revenues through strategic pivots to AI. Others, like TeraWulf, signed multi-billion dollar contracts to facilitate AI compute services. Here are a few notable developments:

- Cipher Mining secured a $5.5 billion lease with Amazon Web Services.

- IREN inked a $9.7 billion contract with Microsoft for GPU-based cloud services.

Such moves underscored the broader industry sentiment that AI offers a viable means of securing revenues beyond Bitcoin mining alone.

ASIC Development and Technological Arms Race

In an environment of fierce competition, ASIC manufacturers ramped up their innovations. In May, Bitmain introduced the Antminer S23 Hydro, boasting a remarkable efficiency of 9.5 J/TH. Meanwhile, companies like Canaan unveiled high-performing units capable of upwards of 300 TH/s. These rapid advancements ensured that operators could bolster performance while trying to keep costs low.

Mining Geography: The Dominant Landscape

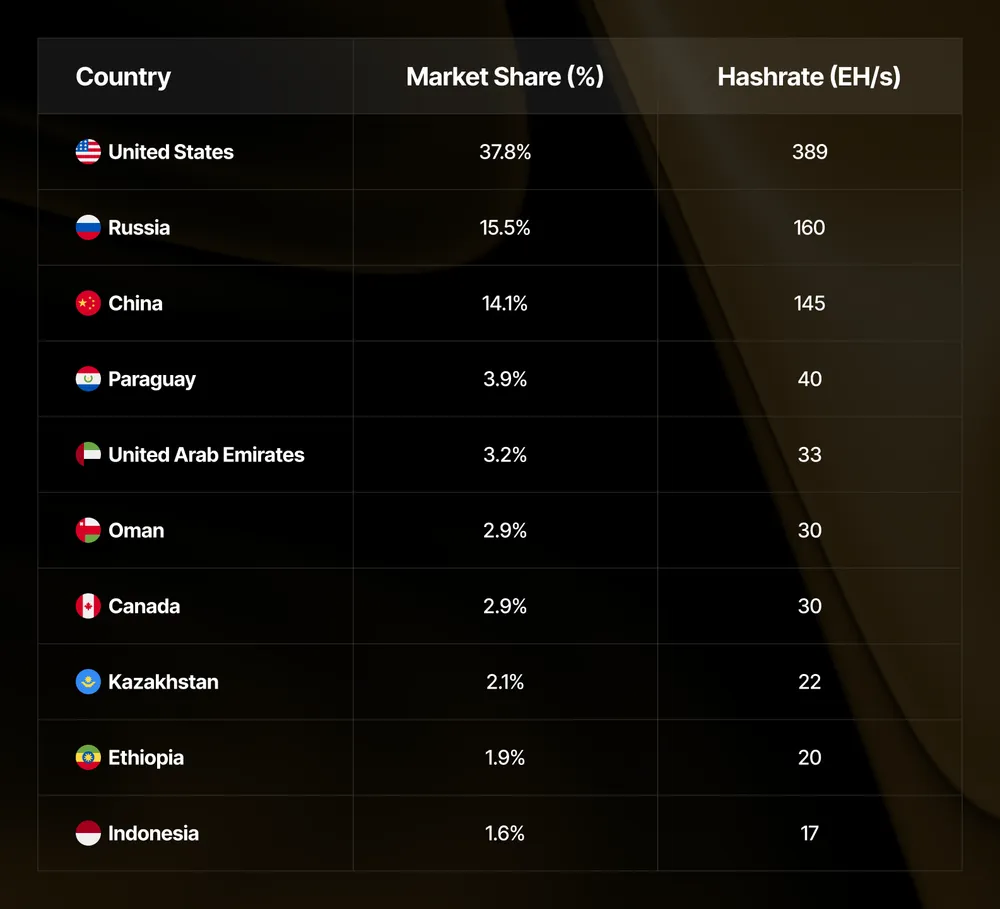

By the close of Q3, the distribution of hashrate revealed a familiar pattern, with the United States commanding nearly 40% of the global share. Russia and China followed, but dynamics showed evolution and even some regression for the latter, despite its underground resurgence in mining activities.

The major players retained their foothold, as Foundry USA, among others, illustrated America’s dominance. The presence of cheap electricity remained a critical factor that dictated where mining operations flourished.

A Future of Transition and Cost Adaptation

While AI revenues remained a minority component of miners’ overall earnings, the trend suggested an upward trajectory. Traditional data centers were beginning to shift to smaller, more agile operations that could capitalize on overlooked power resources.

The coming years will likely usher in even more significant transformations, as the industry braces for the next halving in April 2028, which will further alter the landscape for miners.

With more than two years until that critical moment, miners will need to examine operational efficiencies, expand their technological capabilities, and find new avenues to remain profitable in an increasingly competitive arena.