### BTC Technical Outlook

Bitcoin’s recent performance has brought it down to the lower boundary of a parallel channel, which measures the range from its recent high of $126,000 to a low of $102,000 established in October. This channel’s support level is not reinforced by other significant historical levels, suggesting that a rebound at this point may require a strong catalyst. Notably, the daily RSI has closed at a low of 15.79, a level last seen in late February. This indicates extreme oversold conditions, which have historically been precursors to potential corrective rallies.

For example, during early March, a weekend news-driven surge led to a 20% advance, pushing Bitcoin to revisit the daily TBO Fast line near $97,000. However, this left an unfilled CME gap, which could also weigh on the cryptocurrency’s future performance. Should a rebound occur, traders should keep a close eye on the TBO Fast line around $97,000 and the channel midpoint at roughly $95,000. Although extreme oversold readings can increase the likelihood of a bounce, they do not guarantee an immediate reversal.

—

### Ethereum and Stablecoin Dominance

Ethereum has also extended its decline, printing a third consecutive daily TBO breakdown and entering oversold territory. However, its daily RSI remains less bearish compared to Bitcoin’s, indicating that Ethereum may experience a corrective bounce sooner, even while the TBO breakdown signals potential further downside.

Interestingly, the combined stablecoin dominance chart has attracted attention after reaching a local high of 8.859%, surpassing the 8.75% “max fear/pain” threshold noted on August 5, 2024, and April 7, 2025. A sustained breakout above this level would effectively confirm a bear market environment for Bitcoin and altcoins. Conversely, a reversal could potentially mark a market-wide bottom. The daily RSI has shown higher highs, and a bullish TBO Cloud with an upward-curling Slow line currently seems to favor a continuation to the upside, subject to confirmation from today’s candle close.

—

### Crypto Dominance Shifts

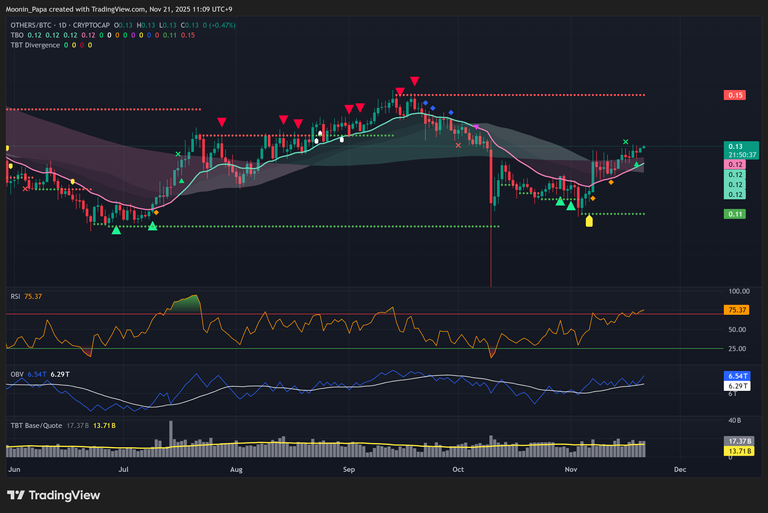

Bitcoin Dominance (BTC.D) recently confirmed a TBO Open Short on the daily close, which signals further declines towards TBO support at 57.37%, commonly associated with a bearish cycle. In contrast, Solana Dominance (SOL.D) has achieved a second daily TBT Bullish Divergence, indicating ongoing capital rotation into Solana, despite Bitcoin’s unfavorable close. Additionally, the Top 10 Dominance has produced its third consecutive TBT Bullish Divergence cluster, while the “Others” category continues to gain traction, showcasing overbought RSI readings that highlight broadening altcoin interest.

—

### Market Cap Trends and Macro Environment

The overall crypto market cap (TOTALES) has further declined, driving its daily RSI to 19.56, the lowest level since late February. Meanwhile, the “Others” segment is trending towards its daily TBO support without any bullish reversal signals in sight. On the flip side, TOTAL3ESBTC remains above its daily TBO Cloud, edging into strong bullish territory, echoing the trend seen in OTHERS/BTC. A decisive reversal in stablecoin dominance is crucial for any sustainable rally in the crypto market.

In traditional markets, the DXY index has risen to 100.360, echoing levels from November 5, yet its daily RSI exhibits lower highs, suggesting diminishing upside momentum. While there is a daily TBO bullish bias alongside a curling Slow line, the weekly TBO Close Short warns of a possible retreat toward 97.714 before any rebound can be anticipated. This scenario could potentially ignite a late-year rally in equities. The equity markets experienced sharp declines, with the S&P 500 down by 1.56%, and the Nasdaq 100 fell by 2.38%, heavily influenced by a 3.15% decrease in NVDA. Likewise, notable declines were registered in the Nikkei, Shanghai Composite, and Hang Seng, further confirming a risk-off sentiment in the markets.

—

### Altcoin Highlights

The technical setups for major altcoins remain mixed. BNB has closed below key support levels, showcasing declining OBV and bearish volume dynamics. Solana’s price remains subdued, even as its dominance outperforms. Dogecoin is resting at historical TBO support (~$0.15) and is poised for a bounce if stablecoin dominance starts to reverse. Meanwhile, Litecoin has broken through its daily TBO support but may lead any subsequent altcoin rally.

Monero has achieved a daily TBO Close Long and is waiting to tag the Fast line, while CRO is hovering near a support fan around 0.09323—a historically significant level for reversals. ZEC has successfully executed a Springboard Bounce off TBO resistance. Notably, ASTER and ATOM are exhibiting 4-hour TBO reversals. MORPHO is maintaining its multi-touch support range, while AERO faces the potential for further downside unless an imminent bounce occurs. Moreover, XTZ is testing daily TBO support, STRK maintains a bullish bias above its cloud, and recent 4-hour bearish divergences in Telcoin imply caution.

Overall, the performance of altcoins is significantly influenced by the crucial reaction in stablecoin dominance, posing a key factor for traders and investors alike.

Learn my strategies and the tools I use every day by visiting [The Complete Cryptocurrency Investor by Mastering Assets](http://www.masteringassets.com/?utm_source=kitco.com&utm_campaign=commentaries&utm_medium=text-link).

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.