The Current State of the Cryptocurrency Market: Liquidations and Future Prospects

The cryptocurrency market is navigating through turbulent waters, marked by significant price declines and mass liquidations. As of November 17, the total crypto market cap stands at approximately $3.12 trillion, reflecting a 2% drop from previous levels. This downturn has resulted in over 154,000 traders facing liquidations, amounting to a staggering $801 million. Notably, around $500 million of this total involved long positions, exacerbating the ongoing market selloff.

Crypto Traders Fear for the Worst

Recent months have seen a series of intense sell-offs, leading to a growing sense of dread among crypto traders. The cumulative crypto market cap has plummeted by more than $1.1 trillion over the last 41 days, fueled primarily by heavy liquidations of long traders. This backdrop has fostered an atmosphere of fear, with the Crypto Fear and Greed Index, tracked by Binance-backed CoinMarketCap, dropping to a chilling 17—almost its lowest point for the year.

As liquidations mount, the mood among traders teeters on the edge of panic. This fear is palpable and contributes to a self-reinforcing cycle of sell-offs, where the market’s downward momentum becomes hard to arrest.

What’s Next for Altseason?

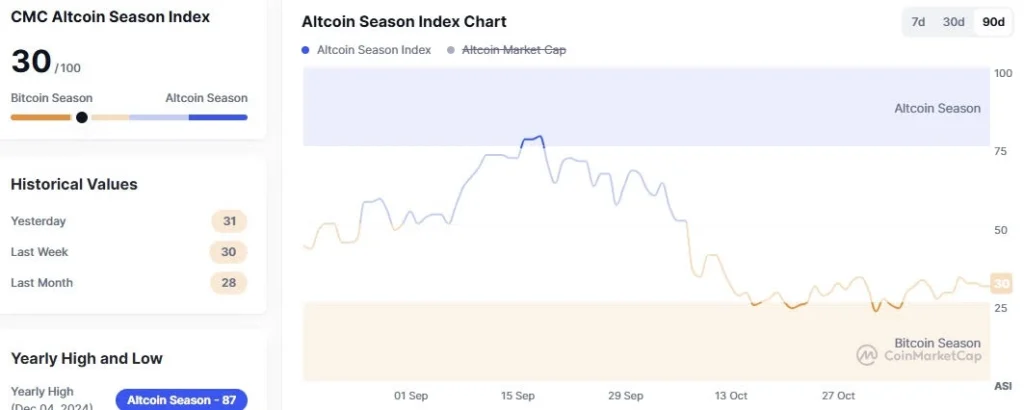

Despite the current challenging environment, there are signs that traders are still looking toward a potential altcoin season. According to market analyses from CoinMarketCap, the Altcoin Season Index has lingered around 30 out of 100, reflecting overall pessimism as most projects continue to bleed value amidst dwindling liquidity.

While optimism for altcoins might seem dim, key macroeconomic events could shift the narrative in favor of cryptocurrencies. Historically, increased global liquidity has bolstered bullish sentiment within the crypto sector. Some critical macroeconomic developments to watch include:

- U.S. Stimulus Checks: The U.S. government is preparing to issue $2,000 stimulus checks.

- Japan’s Plan: Japan is rolling out a $110 billion stimulus package.

- China’s Expansion: China recently approved a $1.4 trillion stimulus package.

- End of Quantitative Tightening: The Federal Reserve plans to officially halt Quantitative Tightening on December 1.

- Canada’s Reversal: Canada is rebooting its Quantitative Easing program.

- Record Money Supply: The global M2 money supply has reached a staggering $137 trillion.

- Rate Cuts: Over 320 global rate cuts have occurred in the last 24 months.

These developments could herald a new chapter for the cryptocurrency market, offering opportunities amid the current volatility.

Trust with CoinPedia:

CoinPedia has been a reliable source for accurate and timely updates in the cryptocurrency and blockchain space since 2017. Our expert team adheres to strict editorial guidelines, ensuring that all content is fact-checked and reliable.

Investment Disclaimer:

All insights and opinions expressed represent the author’s perspective on prevailing market conditions. It’s essential for readers to conduct their research before making any investment decisions.

Sponsored and Advertisements:

Please note that the site features sponsored content and affiliate links, which are clearly marked. Our editorial content remains entirely independent from advertising partners.