**Ethereum Investors Realize Over $800 Million in Profits**

Ethereum (ETH) has recently experienced a significant surge in profit realization, with investors cashing out more than $800 million on Friday. This substantial figure highlights the volatility and opportunistic nature of the cryptocurrency market. The profit-taking comes after Ethereum’s price dipped to around $3,800 on Thursday, marking its first fall below the $4,000 threshold in over a month, a psychologically important barrier for many traders.

[04-1758943535893-1758943535895.22.01, 27 Sep, 2025].png)

*Source: Santiment*

**Open Interest Decline and Heavy Liquidations**

In tandem with the profit realization, Ethereum’s open interest has seen a noticeable decline following a series of heavy liquidations. On Tuesday, liquidations reached a staggering $490 million, which was closely followed by another $401.8 million on Thursday. Such drastic movements signify a shakeout of excessive leverage in the market, particularly on platforms like Binance. A recent report from CryptoQuant pointed out that the average monthly open interest has slumped sharply, representing one of the most significant resets since the beginning of 2024.

The implications of these liquidations are profound, as they tend to breed caution among investors. Historically, significant drops in open interest correlate with further weak price movements and increased distribution. As traders digest the situation, sentiment is cautious, and many investors are on high alert for possible downturns in price.

**Whale Accumulation in the Midst of Uncertainty**

Despite the negative price action and market anxiety, some bullish indicators have emerged. Data from Lookonchain reveals that “smart money” wallets have bought the dip, accumulating a total of 406,117 ETH—valued at approximately $1.6 billion—over the past two days. Notable players in this accumulation include Kraken, Galaxy Digital, BitGo, and FalconX.

Interestingly, two Ethereum wallets that had remained dormant for over eight years transferred a significant sum of 200,000 ETH, worth about $785 million, to new addresses. The origin of these tokens can be traced back to Bitfinex transactions. It’s noteworthy that the holder of these dormant funds still possesses over 736,316 ETH across multiple wallets, representing a substantial value of around $2.89 billion.

*Source: Trading View*

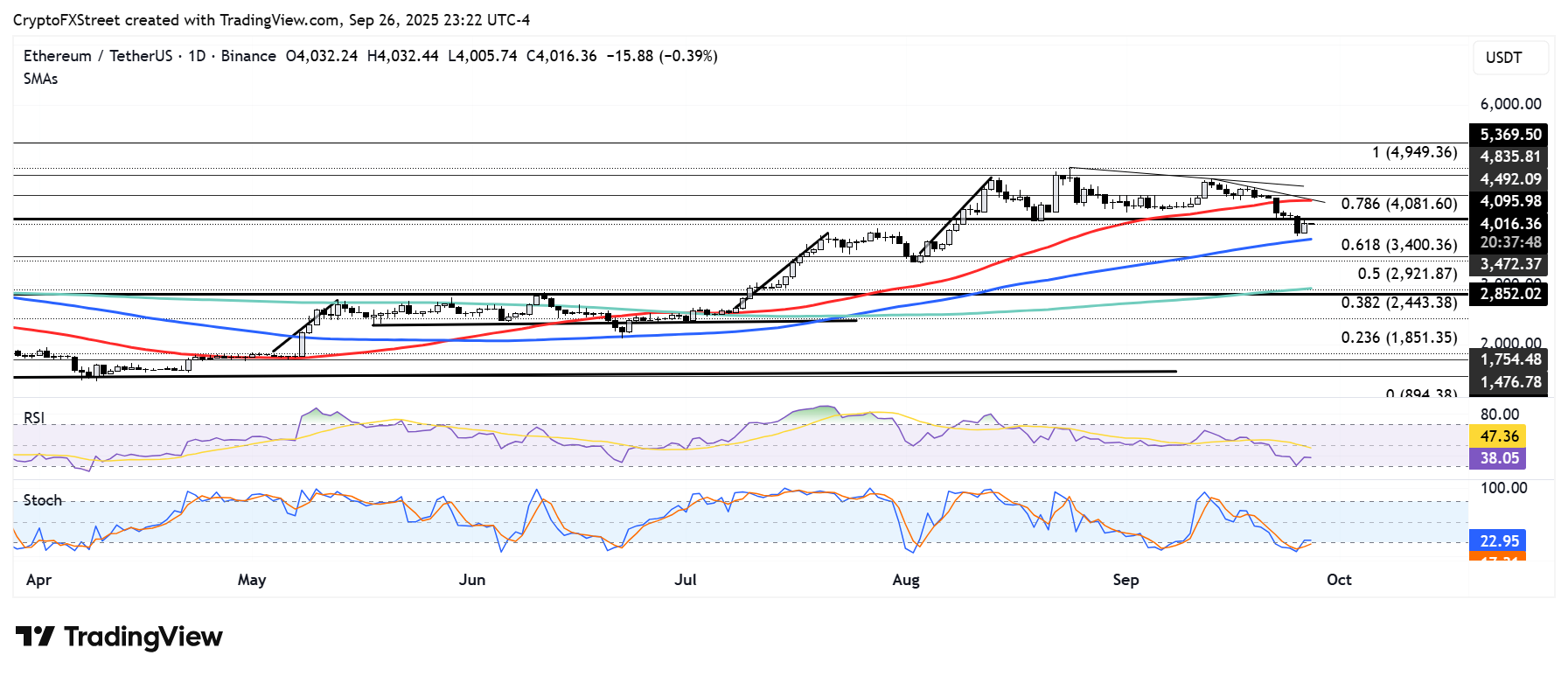

**Price Recovery Attempts and Technical Analysis**

As market participants watch for signs of stability, Ethereum is currently attempting to re-establish itself around the $4,000 psychological level. This recovery effort has found support as ETH tests the 100-day Simple Moving Average (SMA), a technical indicator often relied upon by traders. The top altcoin faces significant resistance near the $4,100 mark, which has proven to be a critical hurdle over the last year.

If Ethereum manages to break above this resistance, the next target could be the $4,500 level, which lies just above the 50-day SMA. Conversely, should the bulls fail to maintain momentum, they may have to defend the 100-day SMA, with the $3,500 level serving as potential support.

—

Ethereum’s recent fluctuations, marked by substantial profit realizations and liquidations, exemplify the cryptocurrency’s inherent volatility. Market sentiment remains a mixed bag, with whale accumulation offering a glimmer of hope amidst uncertainty. As investors navigate this tumultuous landscape, the interplay of technical analysis and market psychology will undoubtedly shape the path forward for Ethereum.