TL;DR

- ETH dominance rebounds near 13%, historically linked to major cycle bottoms.

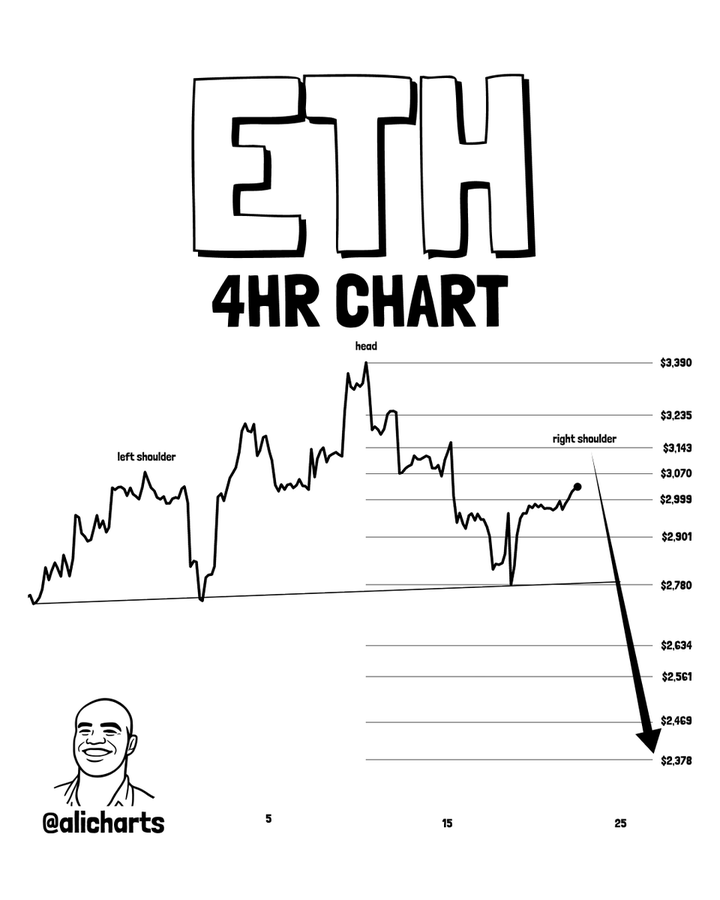

- Head and shoulders breakdown signals a potential dip toward the $2,400 zone.

- Ethereum ETF inflows indicate institutional accumulation despite price weakness.

- Market balance relies on reclaiming $2,899 or defending support amid volatility.

As Ethereum approaches a critical juncture, a blend of technical indicators and fundamental sentiments shapes its outlook. Short-term analytics suggest a possible downturn towards the $2,400 range, while long-term metrics and increasing ETF inflows underscore robust underlying demand. Analysts note the market is straddling the line between corrective pressures and recovery triggers—bringing a nuanced complexity to Ethereum’s journey ahead.

Ethereum Dominance Stabilizes After Prolonged Decline

The recent Ethereum dominance chart, flagged by analyst Gordon, paints a picture of resilience. ETH’s market share has seen a drop from over 20% to approximately 14%, influenced significantly by cycles of altcoin rotations and spikes in Bitcoin’s dominance. However, the latest price movements suggest a rebound from the crucial 13% horizontal support zone, a level often correlated with significant cycle bottoms.

SOURCE: X

When evaluating volume activity during recent dips, signs of defensive accumulation emerge rather than panic selling. Historical trends reveal that Ethereum typically rebounds from similar regions, especially during impactful network upgrades or notable institutional purchases. If the prevailing downtrend breaks, analysts forecast a potential comeback to the 16%-18% range, with a possible extension towards 20% contingent on broader market dynamics.

Conversely, risks loom large if Bitcoin’s outperformance persists. Sustained Bitcoin strength could hamper Ethereum’s recovery, delaying any potential altcoin expansion. Currently, the consolidation of dominance hints that any immediate downside momentum may be waning, setting the stage for a potential turnaround.

Ethereum Price Faces Head and Shoulders Breakdown Risk

On another front, analyst Ali has highlighted concerning patterns for Ethereum’s price trajectory, specifically a head and shoulders configuration forming on the four-hour chart. The pattern, characterized by a neckline at $2,899, experienced a break, signaling a shift in market sentiment and confirming short-term seller control.

Based on measured move projections stemming from this formation, a decline to around $2,400 seems plausible. Historical resistance levels at $3,099 and $3,235 are now positioned as overhead barriers that could hinder any recovery attempts. Analysts note that without reclaiming the neckline, Ethereum risks prolonged bearish pressure and an extended slump.

However, it’s essential to recognize that head and shoulders patterns may lose effectiveness if price levels are reclaimed swiftly. Thus, a sustained close above $2,899 could shift the narrative toward stabilization, offering a pivot point around $2,700. Until such recovery is confirmed, bearish risks remain at the forefront.

ETF Inflows Provide Fundamental Support for ETH

In contrast to these bearish technical signals, fundamental indicators suggest a more promising narrative for Ethereum. Recent data presented by Ted Pillows highlights consistently positive ETF flows, particularly within Grayscale’s ETHE, which saw a substantial single-day purchase of $84.6 million.

Cumulatively, ETF inflows reached $177.7 million earlier in the month, showcasing sustained interest from institutional players despite market fluctuations. This consistent inflow trend indicates a strategic accumulation phase among longer-term investors, suggesting an ability to buffer against selling pressures. Historically, such institutional demand serves as a stabilizing force during market corrections.

Nevertheless, inconsistencies among providers pose a challenge, as varying fee structures and uncertainties surrounding staking influence investor decisions. If positive inflows persist, Ethereum could find sturdy support at current levels and potentially gear up for a push back toward the $3,000 mark. However, without ongoing consistency in inflows, reliance on ETF demand might fall short in counteracting broader market weaknesses.

In the current landscape, Ethereum finds itself at a technical crossroads where short-term caution is advised, contrasted with longer-term dominance trends and meaningful ETF inflows hinting at resilience. The subsequent directional movement will likely hinge on whether buyers can defend critical levels as institutional interest continues to evolve.