Bitcoin is holding on for dear life near the $110,000 level, currently trading at $109,786. After immense selling pressure over the week, this market-leading crypto asset is clinging to the current level, creating the impression that a bear market may be on the horizon.

This downturn is not exclusive to Bitcoin, though. In fact, altcoins are experiencing even heavier losses as investors flee the market. Ethereum has seen a drop of over 10% in just a week, while other notable assets like Solana and Dogecoin are enduring losses of up to 14% during the same period. The sharp correction caught many traders off-guard, leading to what can only be described as a panic sell-off.

The scale of the market’s turmoil is staggering, with over $4.6 billion in liquidations occurring over a mere four days. Hundreds of thousands of traders were forced to close their positions at a loss, compounding the stress and uncertainty within the market. Most of those caught in this trap were investors betting on a bullish market, making their sudden disillusionment all the more pronounced.

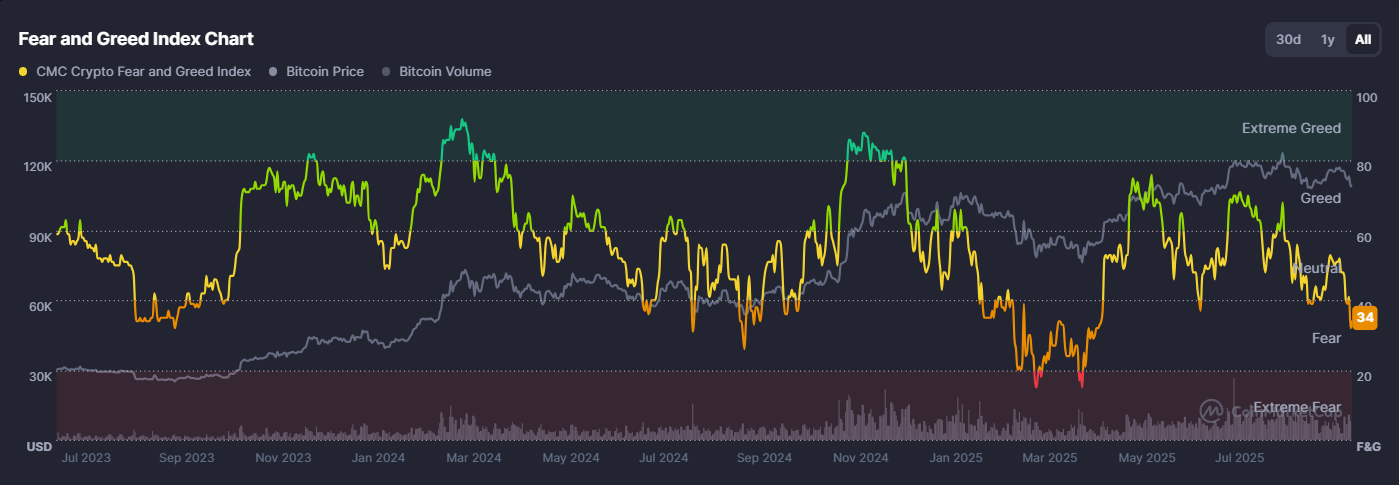

Adding to the sense of dread is CoinMarketCap’s “Fear & Greed Index,” which recently plummeted to its lowest point in 20 weeks. This metric, designed to analyze overall market sentiment, bucks the notion that we are merely facing a temporary market correction, suggesting that more significant issues could be at play.

Market sentiment is a key indicator; however, it is not infallible, often raising false alarms. The critical question remains: are we at the early stages of a market direction change, or will crypto’s bull run exceed expectations as we head into the last quarter of the year?

Who’s Afraid of Bears? (Most People)

In traditional finance, analysts often refer to the “20% decline rule” to determine if the market is transitioning into a different phase. Though this figure may seem arbitrary, it serves as a guideline for investors to discern between mere volatility and an actual correction. As of September 26, Bitcoin is “only” about 12% below its August 14 high. While recent performance may appear underwhelming, this metric leaves the door open for potential recovery.

Bitcoin/USD – 1D

When examining the total cryptocurrency market capitalization, the overall trend still retains a somewhat bullish appearance, even as short-term indicators show signs of downward pressure. The cryptocurrency market cap recently slipped below the 50-day simple moving average (SMA) for the first time since June. This serves as a clear indication that near-term selling pressure is currently overwhelming buyers, even as the market trades comfortably above the 200-day SMA.

However, this doesn’t guarantee that the current selling pressure will abate soon. Indeed, the 50-day SMA just began to dip this week, suggesting that while buyers still have room to maneuver, the market may continue to trend downward in the coming days.

So, What’s Causing The Turmoil?

The cryptocurrency market has shed a staggering $319 billion in value since September 17, coinciding with the Federal Reserve’s announcement of a new interest rate adjustment, which dropped by 25 basis points. Initially, this rate cut excited many in the crypto space, raising hopes that it would infuse more liquidity into the financial markets. Fast forward a week, and we find ourselves discussing bearish sentiments instead.

Shortly after the Federal Open Market Committee (FOMC) meeting, the revised second-quarter GDP came out, boasting a surprising growth rate of 3.8%. Additionally, the Bureau of Economic Analysis released the Core Personal Consumption Expenditures (PCE) report, revealing that inflation remains steady but stubborn. This sharp focus on growth and inflation has led to an unusual situation where lower interest rates are occurring alongside indications of economic expansion.

This mismatch has made risky assets like cryptocurrencies and stocks appear less attractive to investors. The ramifications of these developments could explain why the digital assets sector is grappling with declines.

To address the central question of whether or not we are indeed entering a bear market, the answer for now appears to be no. Investors should maintain vigilance around the 200-day SMA. In the interim, upcoming macroeconomic reports will significantly influence cryptocurrency performance as we approach the year’s final quarter.

In the midst of trading opportunities, many platforms are incentivizing user engagement with promotions. For example, BloFin is currently running an September event that allows users to climb from cash-equivalent bonuses to premium offerings, which include grand prizes like an iPhone 15, Apple Vision Pro, and a luxury Omega watch for top-tier participants.