Understanding DeFi Wallets: Your Gateway to Decentralized Finance

Cryptocurrency has taken center stage in recent years, igniting tremendous interest in decentralized finance (DeFi). One of the core principles driving this revolution is the elimination of intermediaries, enabling users to borrow, lend, trade, and earn directly through blockchain networks. However, to access these innovative protocols, you need a reliable DeFi wallet. This article will dive deep into what a DeFi wallet is, how it operates, and its various uses.

What is a DeFi Wallet?

A DeFi wallet is a self-custody wallet designed to store your private keys. Whether software or hardware, it acts as a Web3 provider for compatible applications. Unlike custodial wallets, where a third party holds your keys, DeFi wallets give you complete control. This means only you can authorize transactions linked to your wallet.

Most DeFi wallets are user-friendly, operating as browser extensions—like MetaMask, mobile apps such as Coinbase Wallet, or more secure options, like hardware wallets from Ledger and Trezor. When you interact with DeFi platforms, whether for lending, trading, or earning yields, your wallet enables quick and direct interactions with smart contracts. This streamlined process allows you to engage actively without relying on centralized services.

How Does a DeFi Wallet Work?

A DeFi wallet operates similarly to any other crypto wallet, managing two cryptographic “keys”: your public key (your wallet address) and private key (your signature authority). When you initiate a transaction—say, swapping tokens—the wallet creates a transaction payload and prompts you to sign it using your private key. This process is user-friendly, often requiring just a single click or tap.

Upon signing, your wallet broadcasts the transaction to the blockchain, where it gets validated by network nodes. Once approved, your wallet updates your balances accordingly. Underneath this seamless experience is a complex system of Web3 libraries that enable your wallet to communicate with DeFi applications effectively.

What is a DeFi Wallet Used For?

DeFi wallets are versatile tools that offer numerous functionalities:

- Swapping Tokens on DEXs: You can instantly trade between cryptocurrencies on decentralized exchanges (DEXs) like Uniswap or PancakeSwap without the hassle of KYC requirements.

- Providing Liquidity: Deposit token pairs into liquidity pools and earn fees, helping power automated market makers (AMMs).

- Yield Farming & Staking: Lock assets in various protocols, enabling you to secure networks while earning passive income.

- Lending & Borrowing: Use your crypto as collateral to borrow other assets or lend your holdings to accrue yield.

- Governance Participation: Use governance tokens directly from your wallet to vote on protocol proposals, affecting upgrades and fund distributions.

- NFT Interaction: Manage non-fungible tokens seamlessly, whether minting, buying, or selling, while retaining full custody of your assets.

Types of DeFi Wallets

Software Wallets

Software wallets store private keys directly on your device, enabling immediate access to DeFi protocols.

- Browser Extensions: Wallets like MetaMask and Coinbase Wallet inject a Web3 provider directly into your browser for easy interaction with decentralized applications.

- Mobile Apps: Wallets such as Trust Wallet and Crypto.com’s DeFi Wallet extend accessibility to mobile devices, often integrating WalletConnect for cross-app interactions.

Hardware Wallets

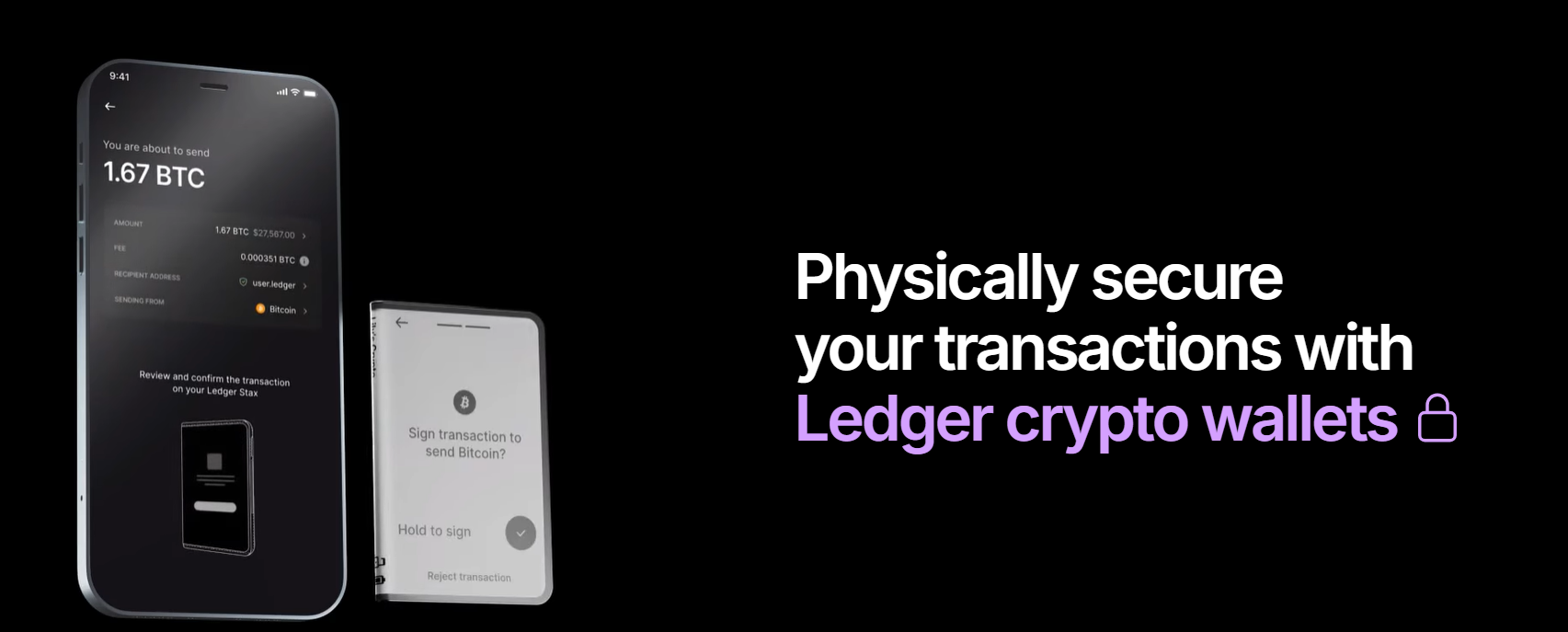

Hardware wallets like the Ledger Nano S Plus and Trezor Model One store private keys in a secure offline device, offering high protection against hacks and malware. You can connect these wallets to Web3 interfaces, signing transactions directly on the device itself without exposing your keys.

DeFi Wallets vs CeFi Wallet: Key Differences

| Feature | DeFi Wallet | CeFi Wallet |

|---|---|---|

| Custody | User controls private keys | Exchange holds keys |

| Counterparty Risk | Minimal—self-custody | Higher—risk of hacks |

| Access | Direct to smart contracts | Through the exchange interface |

| KYC/AML Requirements | Typically none | Mandatory identity verification |

| Fees | On-chain gas fees | Trading and withdrawal fees |

| Service Availability | 24/7, permissionless | Subject to exchange hours |

Benefits of DeFi Wallets

- Complete Control: With your private keys, you eliminate counterparty risks entirely.

- Permissionless Access: Engage with financial services anytime, anywhere, without KYC hassles.

- Composability: Use various features, such as swapping and lending, within a single wallet interface, putting complex financial strategies in your hands.

Risks of DeFi Wallets

While DeFi wallets unlock powerful financial capabilities, they also come with substantial risks:

- Smart Contract Vulnerabilities: Exploits may enable attackers to drain funds.

- Phishing Attacks: Malicious dApps can trick users into authorizing unauthorized transactions.

- Key Management Risks: Storing keys unsafely can lead to theft.

- Transaction Errors: Sending funds to incorrect addresses can result in irreversible losses.

Awareness of these risks is crucial for anyone looking to venture into DeFi.

Key Factors to Choose the Best DeFi Wallet

1. Security

- Local encryption of private keys

- Recovery phrase option

- Biometric or PIN protections

- Compatibility with hardware wallets for cold storage

2. Compatibility and Interoperability

- Support for preferred blockchain networks

- Integration with popular DeFi protocols

- Functionality like WalletConnect for cross-app use

3. User-Friendliness

- Intuitive user interface with clear prompts

- Easy navigation for different functions

- Transaction previews showing fees and potential slippage

4. Features

- Built-in token swaps and staking dashboards

- Portfolio tracking capabilities

- Governance participation tools

5. Reputation and Team

- Transparency through audits

- Active community support and engagement

- Continuous updates and improvements

6. Privacy

- No mandatory KYC or personal data collection

- Preserves user anonymity

- Clear privacy policies regarding usage metrics

7. Community Feedback

- Positive reviews and a supportive community

- Reports of performance and reliability

- Responsive customer support channels

How to Secure Your DeFi Wallet

Start by safeguarding your seed phrase; write it down in a secure location away from digital influences. Use cold storage solutions for larger sums by keeping funds offline. Enable two-factor authentication (2FA) when possible, verify URLs and dApp requests, and regularly review your token approvals to revoke outdated permissions.

Top DeFi Wallets

1. Coinbase Wallet

A non-custodial, mobile-first wallet supporting multiple chains, offering in-app DEX swaps and NFT galleries.

Pros: Easy setup, trusted brand, integrates fiat on-ramp.

Cons: Collects some user data, fewer advanced analytics.

2. MetaMask

This widely-used wallet offers a browser extension and a mobile app for Ethereum and EVM chains, with extensive DeFi integration.

Pros: Ubiquitous Web3 standard, rich plugin ecosystem.

Cons: Limited to EVM-compatible chains, phishing risks exist if not cautious.

3. Ledger Nano S Plus

Recognized for security, this hardware wallet uses a Secure Element chip and pairs with both Ledger Live and MetaMask for DeFi transactions.

Pros: Industry-leading security, Bluetooth for mobile use.

Cons: Requires an external interface for dApps, upfront device cost.

4. Trezor Model One

An open-source wallet that connects via USB, compatible with MetaMask and other Web3 apps.

Pros: Transparent firmware, durable design.

Cons: Lack of Secure Element chip, smaller screen.

5. Crypto.com DeFi Wallet

A non-custodial mobile wallet that integrates easily with the Crypto.com ecosystem, offering DeFi swapping and staking.

Pros: Competitive DeFi rates, built-in yield aggregator.

Cons: Tied closely to Crypto.com branding, occasional UI complexity.

With an understanding of DeFi wallets, you’re prepared to explore the expansive world of decentralized finance. By prioritizing security and choosing the right tools, you can manage your crypto assets effectively while navigating this exciting landscape.